HYBRID ECLOSING

Begin your eClosing journey with a hybrid approach

Take the first step toward full digital closing with a streamlined hybrid eClosing feature that can reduce errors and save time at the closing table. Hybrid eClosing simplifies the mortgage process by blending electronic and traditional closing methods, offering mortgage lenders and borrowers alike greater convenience and flexibility.

Close faster, reduce costs, and improve the borrower experience

Streamline the mortgage closing process by allowing borrowers to preview and electronically sign most loan documents before the closing meeting, reducing friction and saving time for everyone involved.

Loan Officers

Improve client satisfaction by simplifying the signing process, reducing time at the closing table, and offering a more convenient experience.

Closing Professionals

Optimize the closing process by reducing manual tasks, minimizing errors, accelerating turn times, and enabling more efficient transaction management.

Post-Closing Professionals

Accelerate post-closing processes with electronic records that ensure complete documentation, maintain quality control, and enable fast submission to investors.

Compliance Teams

Minimize errors, provide an auditable trail for regulatory compliance, and reduce the handling risks associated with traditional paperwork.

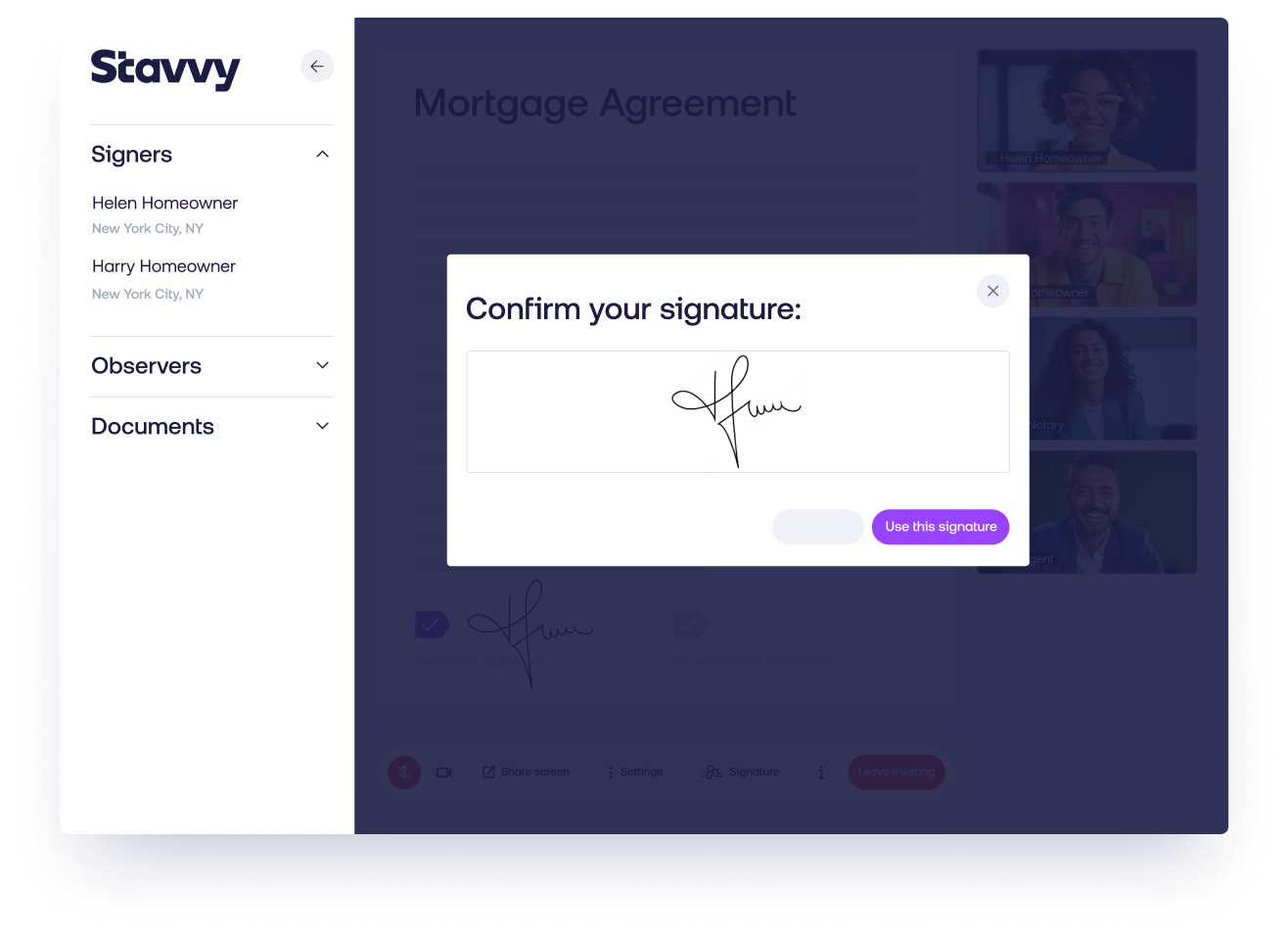

A flexible hybrid eClosing workflow for a modern mortgage experience

| MUST-HAVE HYBRID FEATURES

- Branded user experience

- Share documents for borrower preview

- Schedule a signing window

- Request eSignature

- Quality control review

- Cancel, edit, and redraw

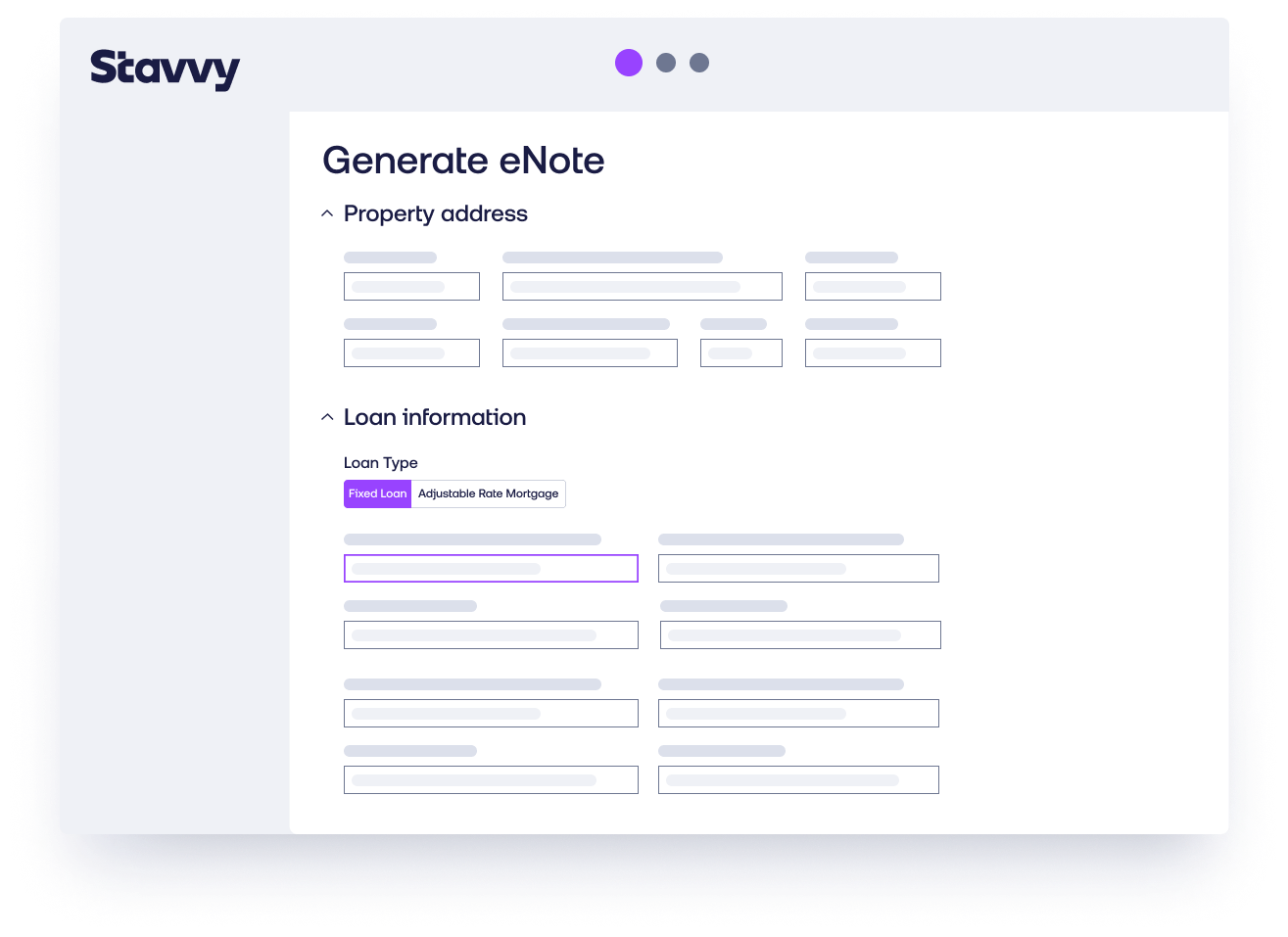

Fast-track funding with hybrid + eNote, enabling quick delivery to the secondary market

| POWERFUL ENOTE & EVAULT FEATURES

Encompass® Integration

Hybrid and Hybrid + eNote with Encompass®

Stavvy’s integration with Encompass® by ICE Mortgage Technology leverages the latest APIs to facilitate secure, user-friendly hybrid + eNote eClosing transactions. It combines Stavvy’s eSign, eNote, and eVault capabilities with ICE’s loan origination platform and the Encompass® document engine for a complete and cohesive user experience.

.png?width=350&height=409&name=Balloon%20(1).png)