DIGITAL MORTGAGE LENDING SOFTWARE

Compliance-driven digital mortgages for a more profitable and efficient lending process

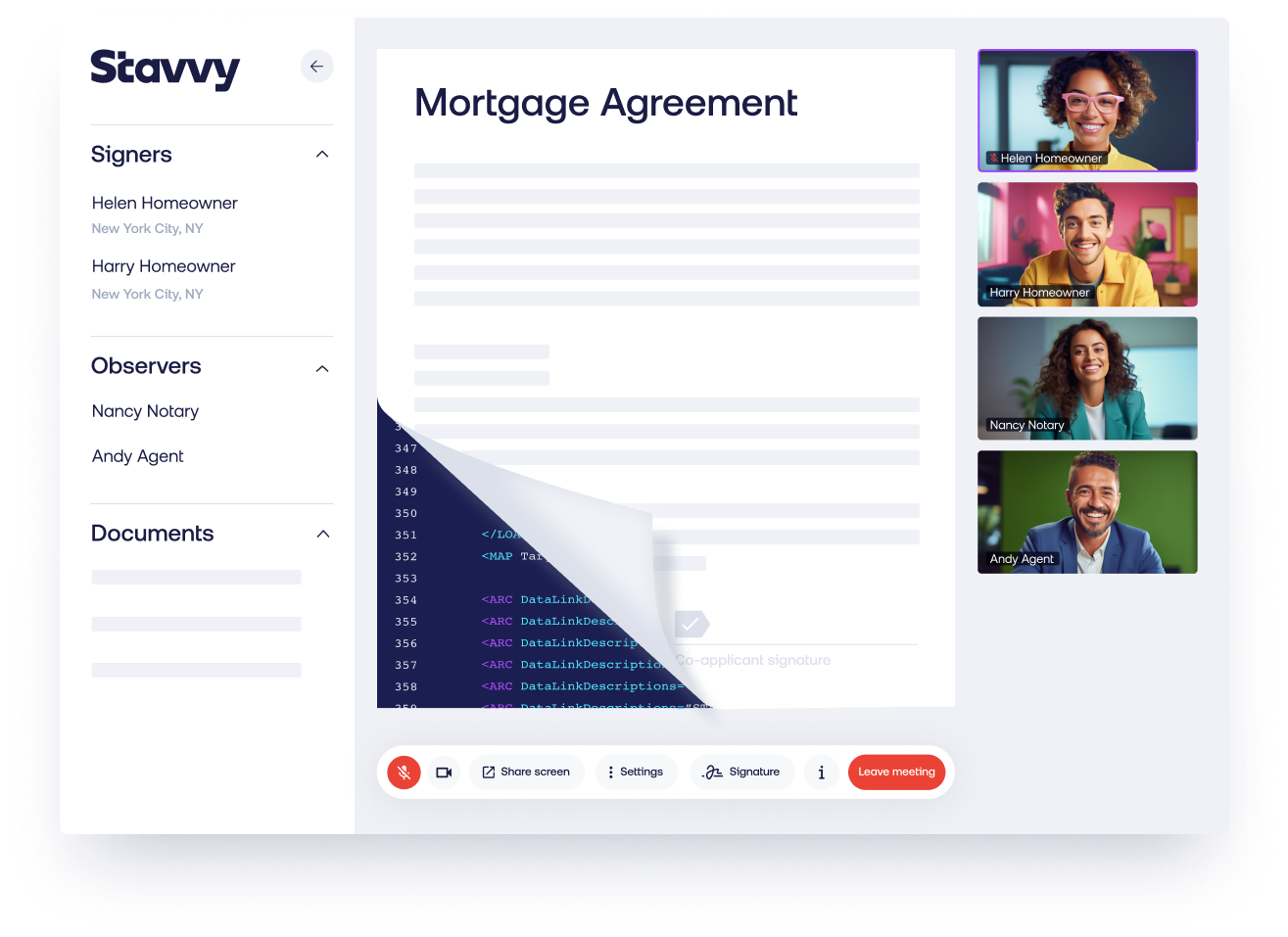

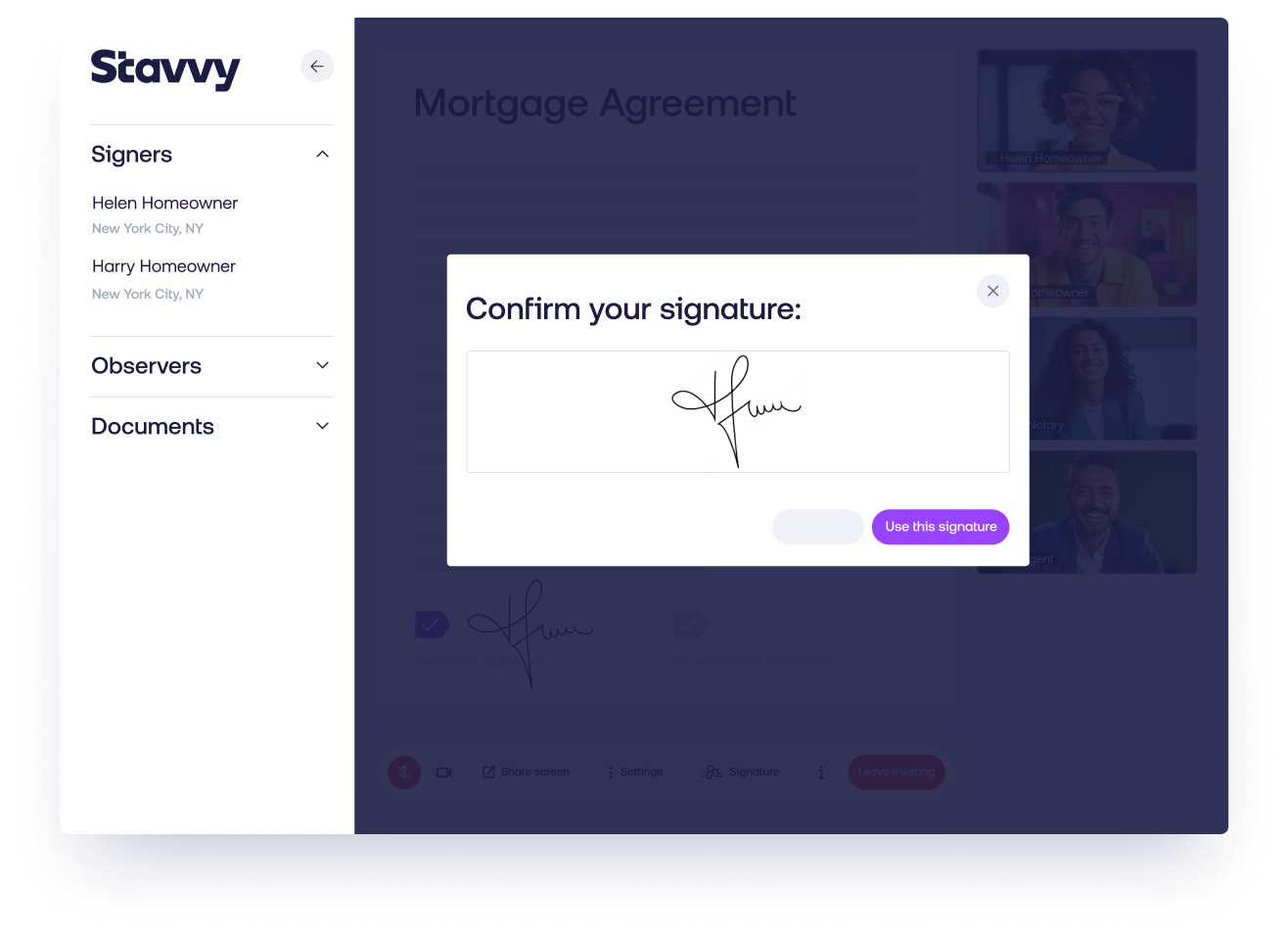

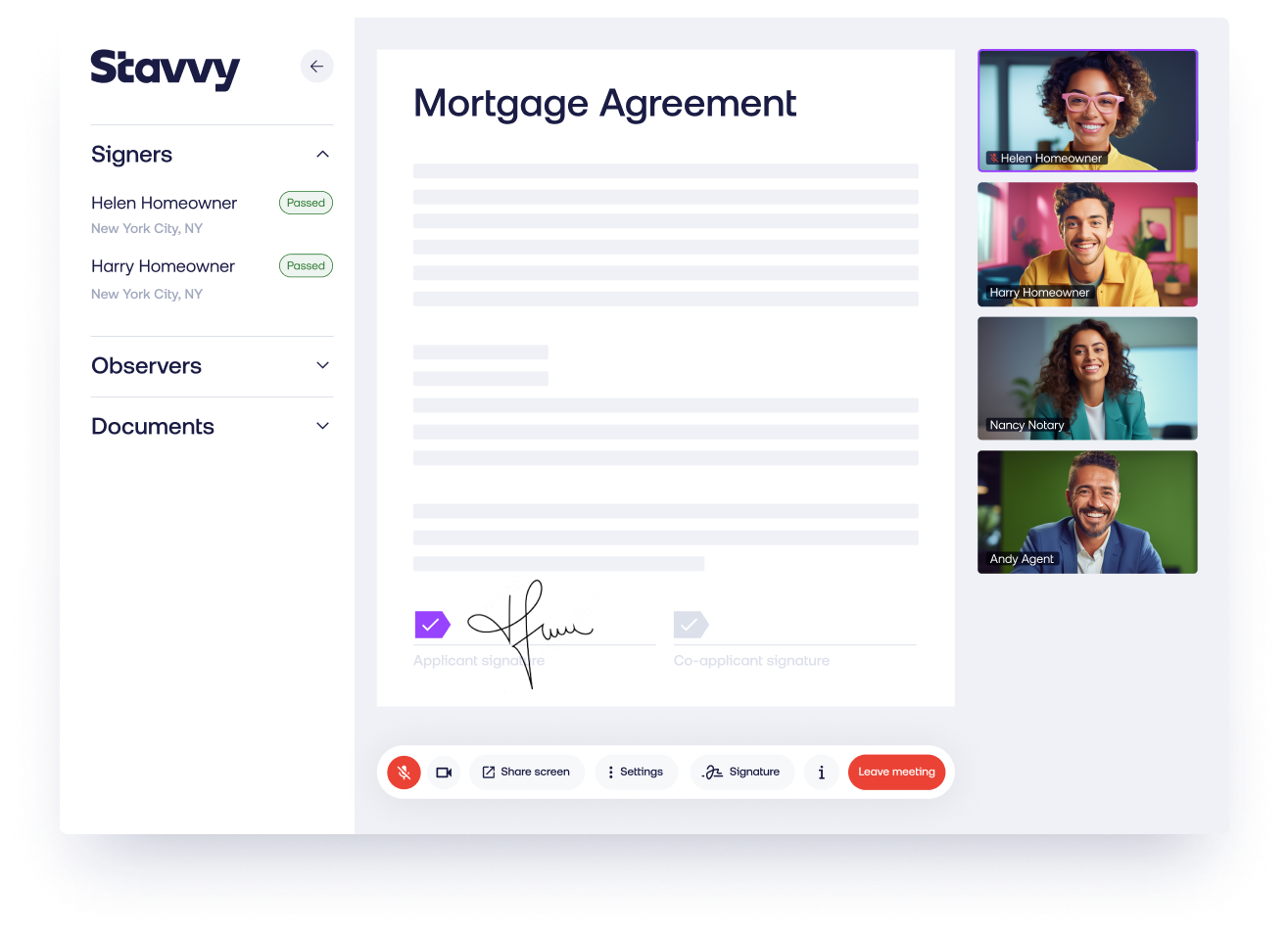

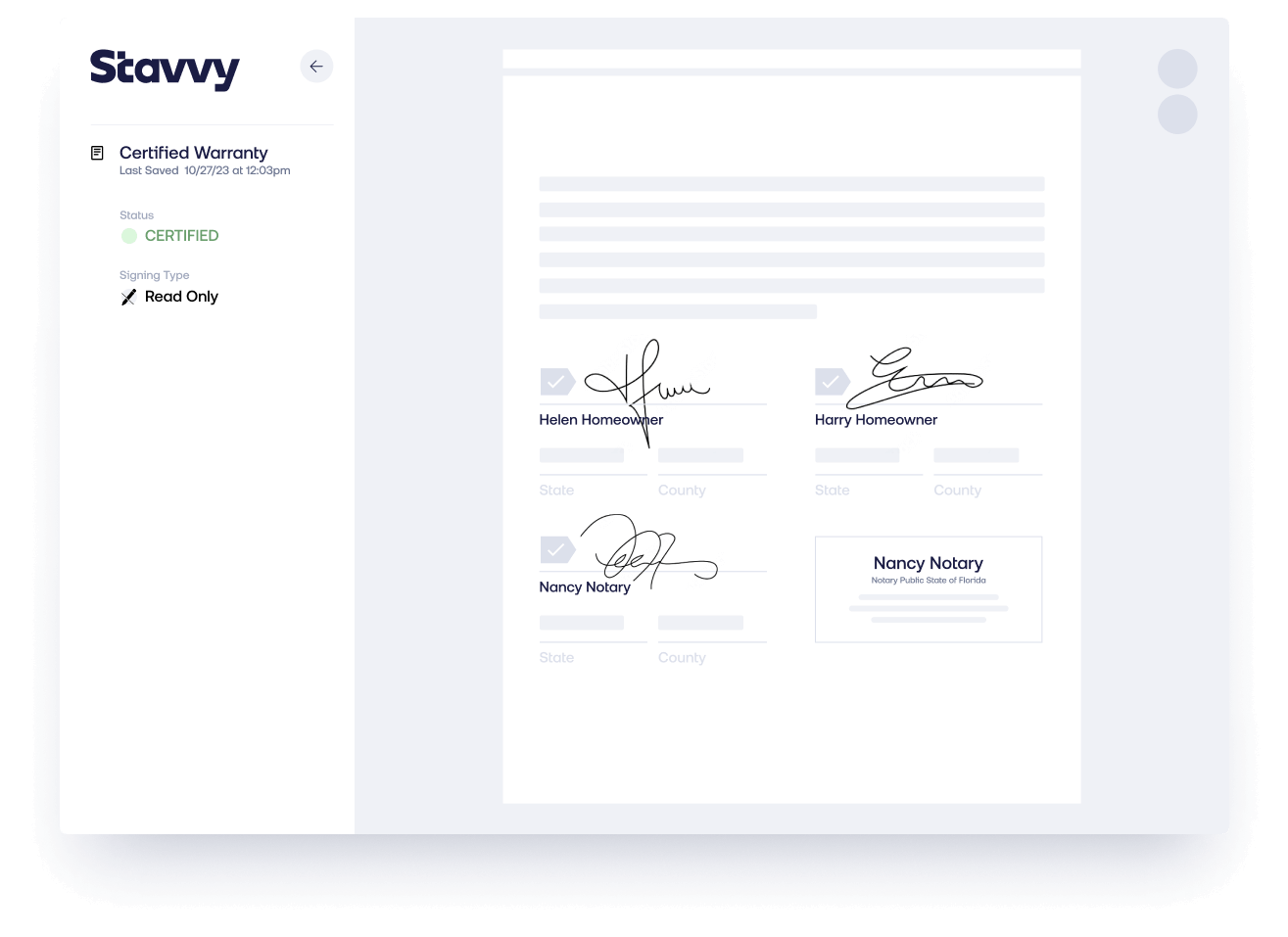

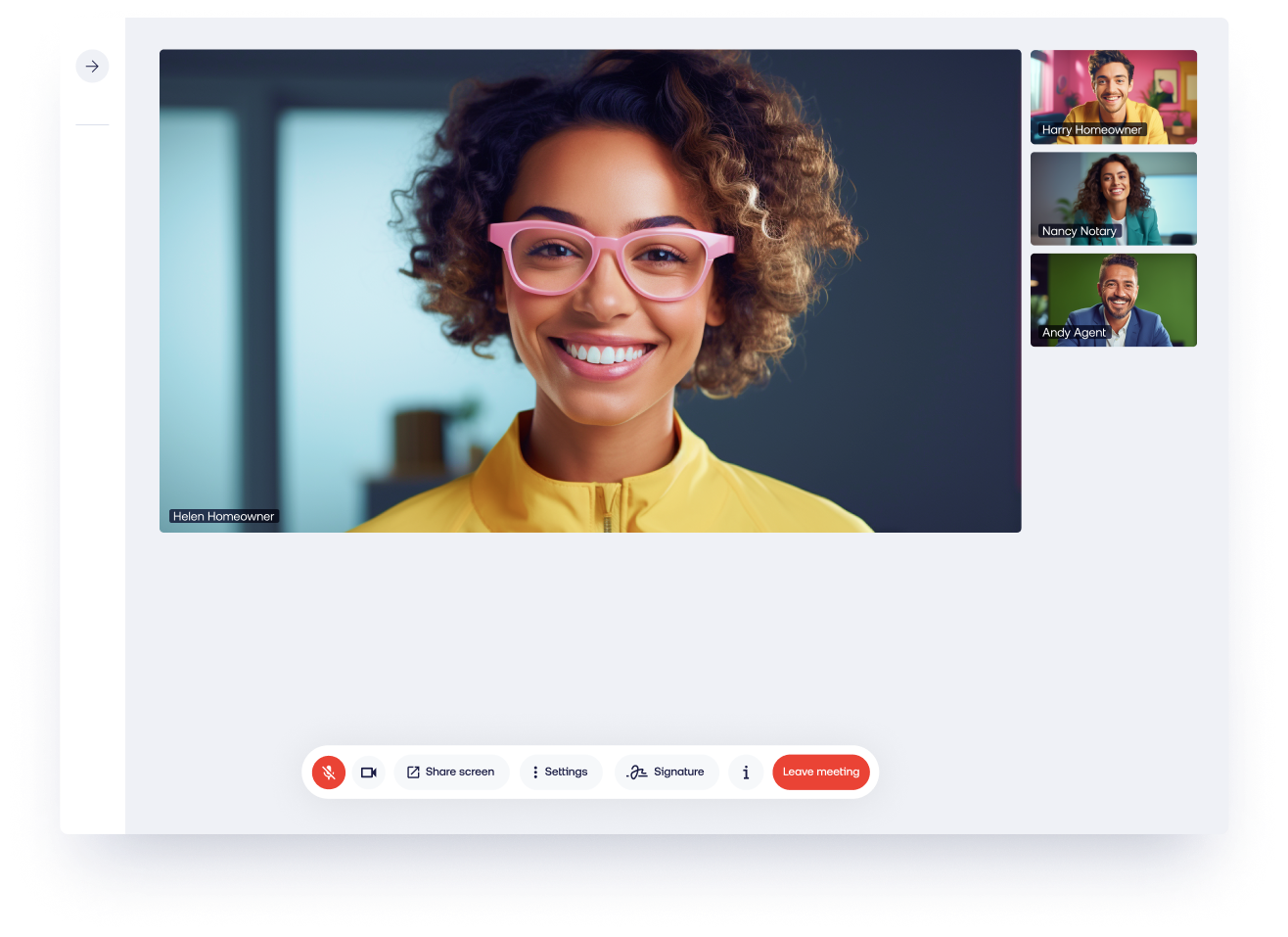

Stavvy delivers a tailored digital mortgage experience for any loan scenario, all within one versatile platform. Lenders can collaborate seamlessly with title and settlement professionals to provide an exceptional experience for borrowers that minimizes cycle times, reduces costs, and ensures secure, compliant loans.

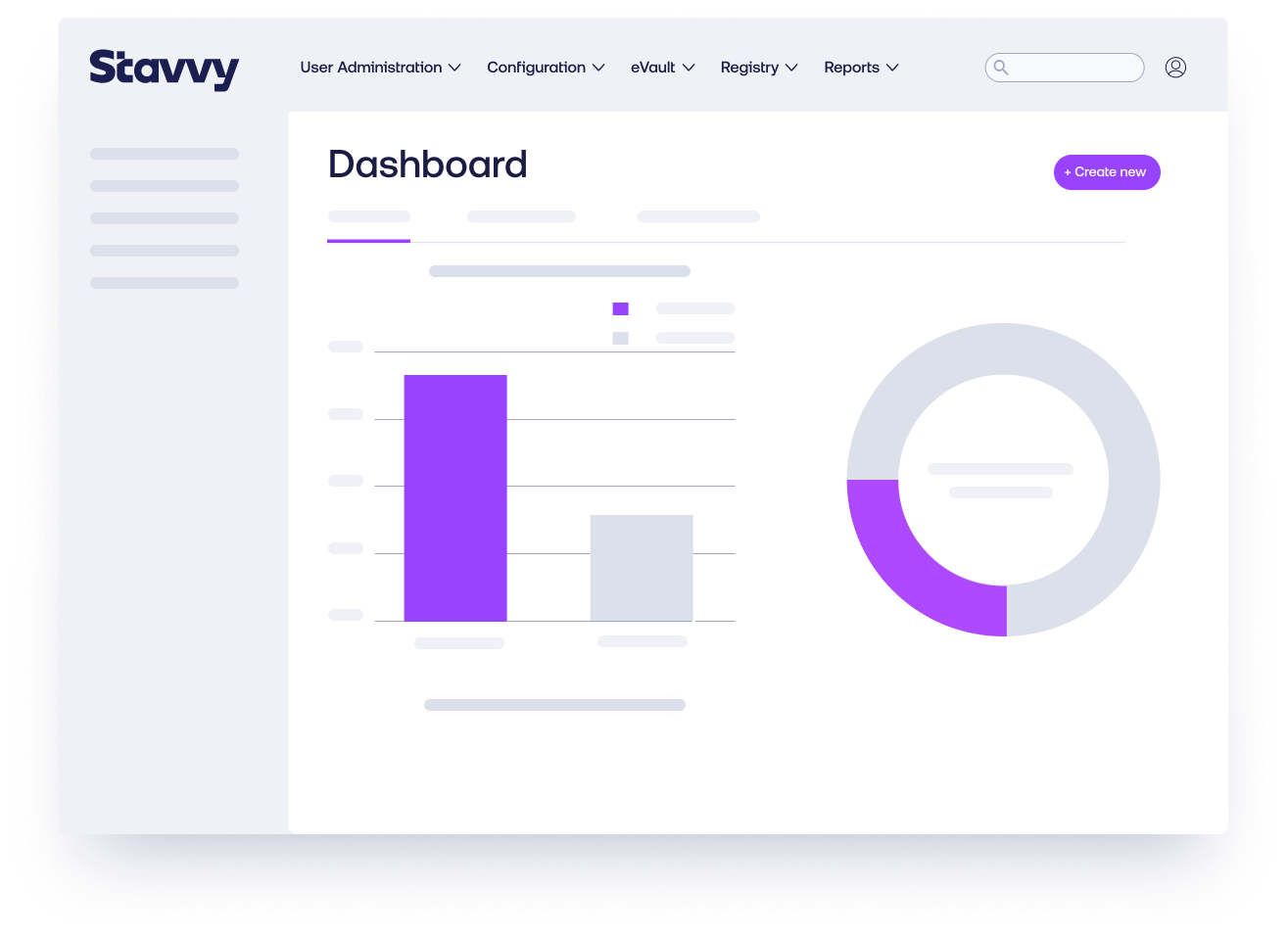

End-to-End Digital Mortgage Platform

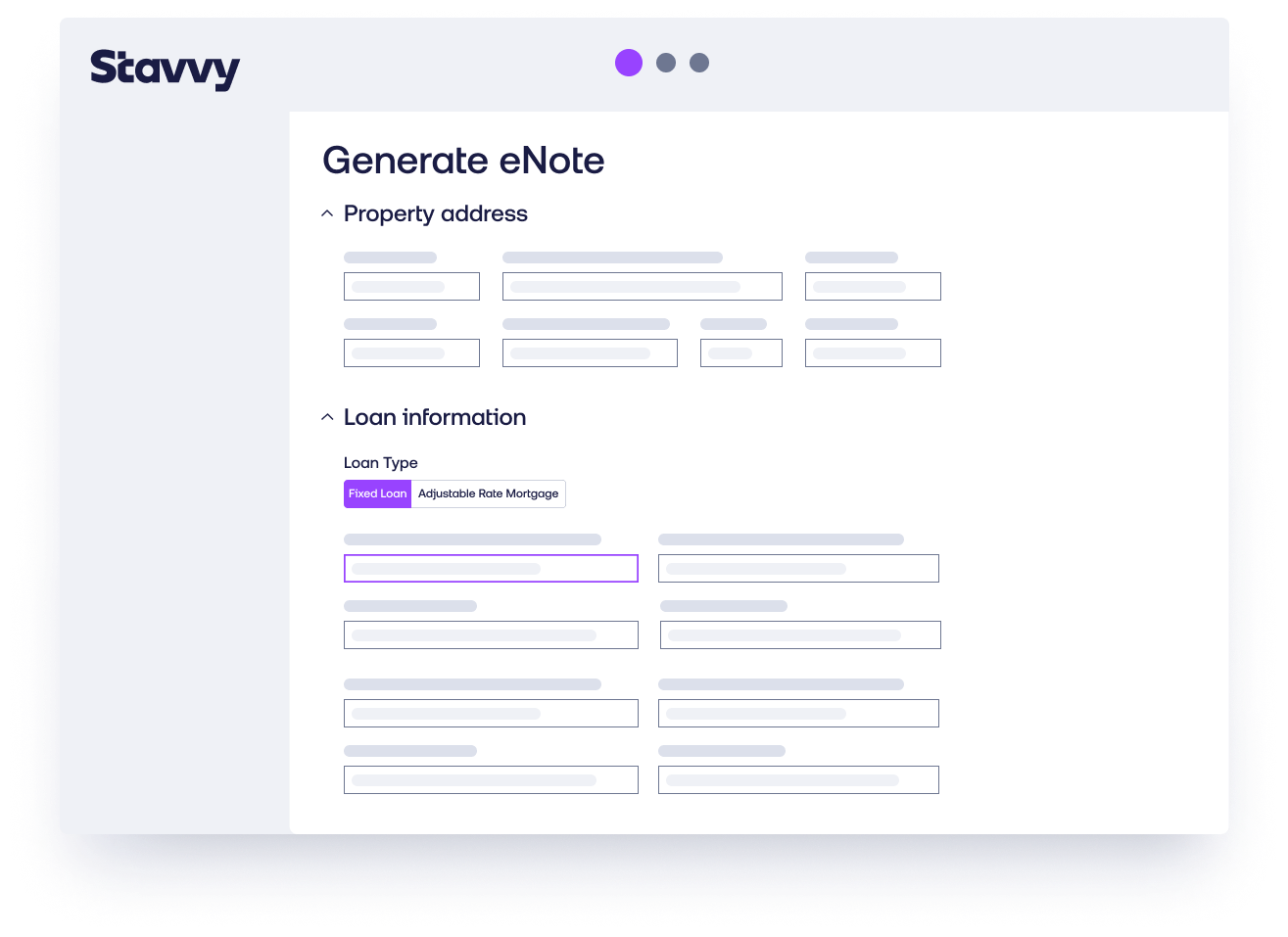

Stavvy’s dynamic digital mortgage platform facilitates a seamless flow of data. It transforms every phase of the loan process, from disclosures and closing to loan delivery and transfer to the secondary market.

eClosing with Encompass®

Stavvy’s integration with Encompass® by ICE Mortgage Technology leverages the latest APIs to facilitate secure and seamless eClosing transactions. It combines all of Stavvy’s eClosing capabilities with ICE’s loan origination platform and the Encompass® document engine for a complete and cohesive user experience.

Trusted by the industry’s leading authorities

Stavvy is certified by MISMO® and approved by Fannie Mae, Freddie Mac, Ginnie Mae, and MERS®. Our platform meets the highest standards for digital transactions, with SOC 2 Type 2 compliance ensuring the integrity and security of your digital assets.