DIGITAL DEFAULT SERVICING SOLUTION

Expand mortgage servicing capacity without compromising consumer experience

Our end-to-end loss mitigation default management platform is a customizable and mobile-friendly solution. Homeowners and mortgage servicers can complete all necessary tasks - from upfront application and processing to final document execution - to speed processing and increase pull-through.

Self-service mortgage software designed to guide homeowners seeking mortgage assistance from anywhere and at any time

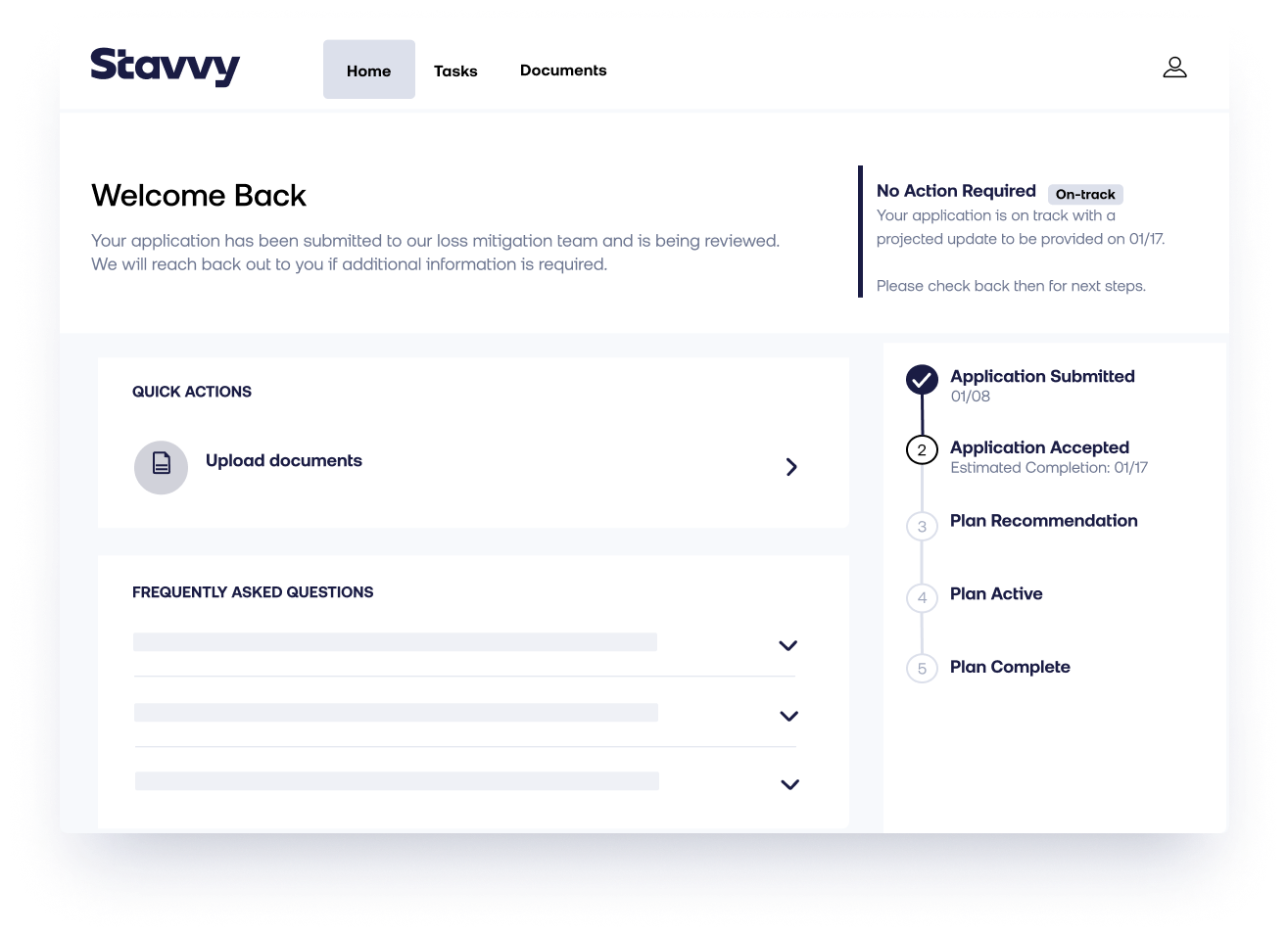

| HOMEOWNER ENGAGEMENT PORTAL

Stavvy’s Homeowner Engagement Portal is a mobile-friendly gateway that allows homeowners to apply for mortgage assistance online at any time. The user-friendly interface guides consumers through each step of the process, automates the upload of data and documents, and quickly directs them to the appropriate loss mitigation option: resulting in faster processing and higher completion rates.

The portal improves homeowner communication by offering multiple channels to keep your customers informed. Stavvy’s borrower dashboard includes a detailed status tracker, supported by email messaging to ensure information is delivered clearly and on time. By keeping homeowners engaged throughout every phase of the loss mitigation process, the portal helps you increase throughput rates until the application is closed.

Increase default management scope while decreasing marginal variable labor costs through automated default management workflows

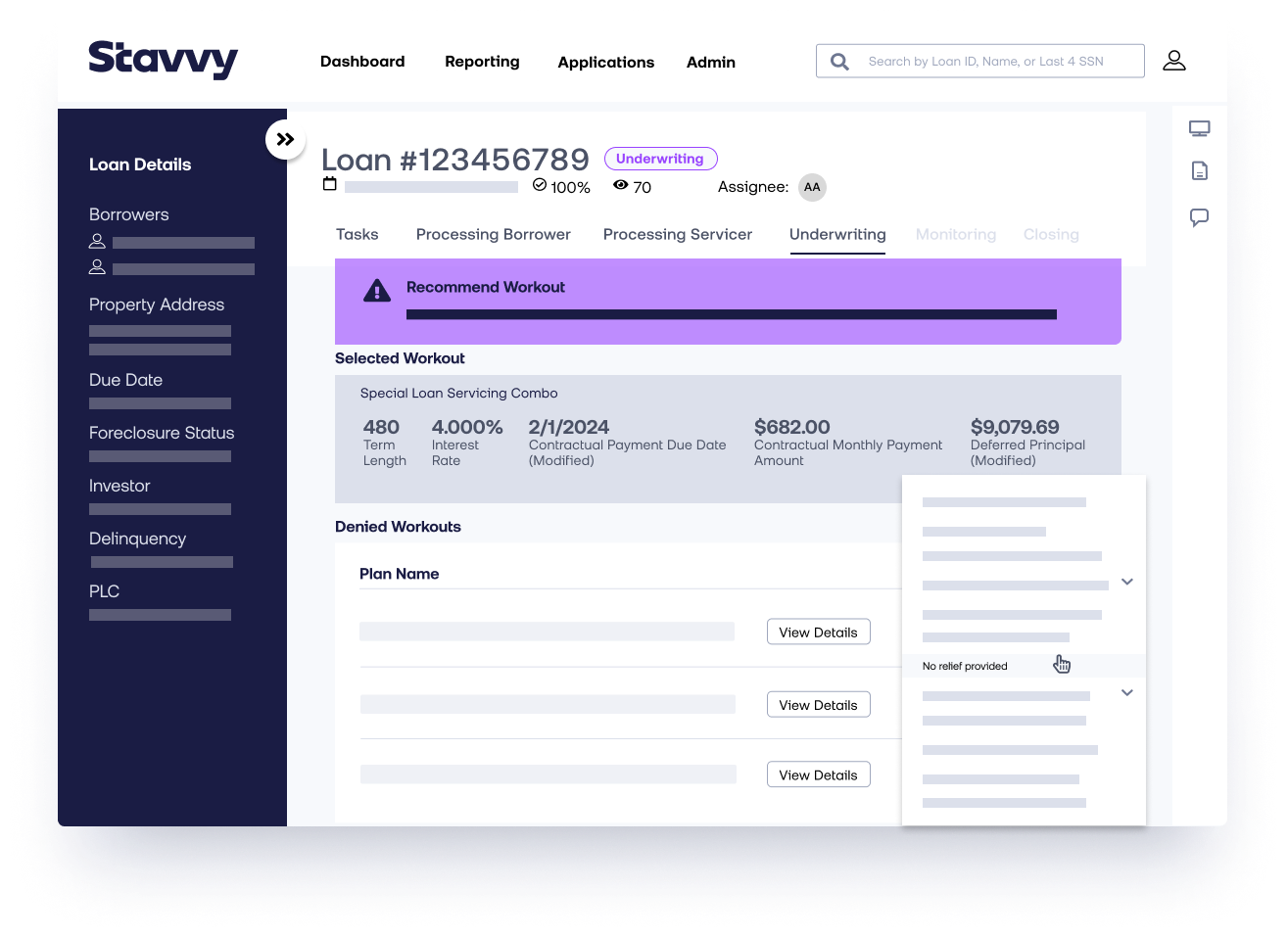

| SERVICER DEFAULT MANAGEMENT PORTAL

The business operations of every mortgage servicer are unique. That’s why Stavvy offers a customizable mortgage servicing software solution that enhances loss mitigation efficiency and compliance while allowing mortgage servicers to define a system that meets their specific workflow parameters.

The Servicer Default Management Portal lets users assign tasks to teams or specialized individuals with workflow customization tools. Stavvy's proprietary Rules Engine further supports mortgage servicing teams by providing real-time decisions against investor/insurer guidelines and compliance requirements based on homeowner-provided data. All while remaining flexible in times of regulatory change, resulting in no compliance-related downtime.

Not all homeowners are willing or able to go digital. Stavvy’s Servicer Default Management Portal lets users bring paper and phone applications online for teams to process digitally. These actions, and all others within the platform, are digitally logged into a fully automated timeline, bringing full visibility to mortgage servicing operations.

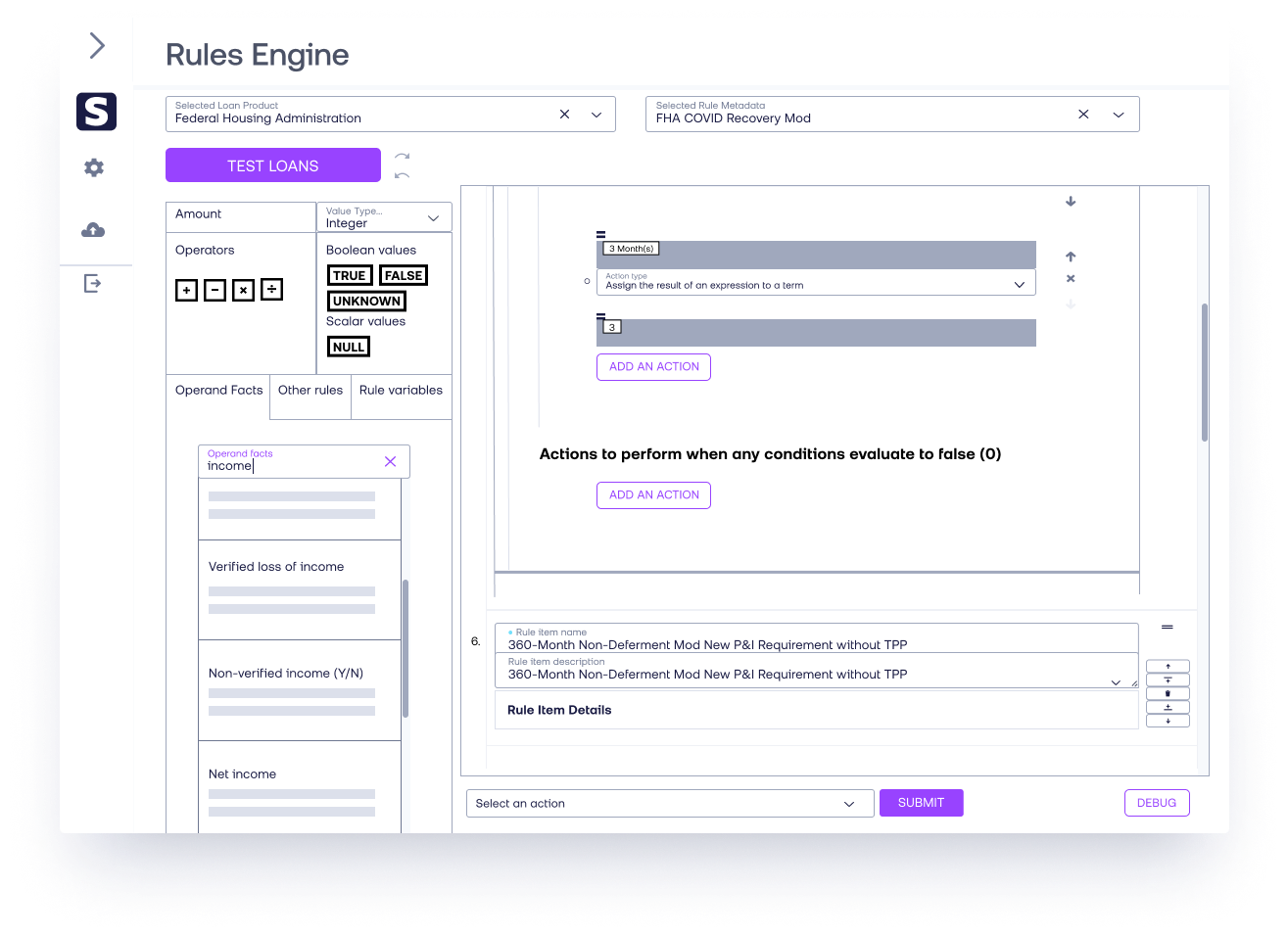

Accelerate workout decisions and automate compliance with a flexible, API-enabled, real-time rules engine

| WATERFALL RULES ENGINE

Built with flexibility in mind, Stavvy’s waterfall calculation rules engine evaluates servicer and homeowner-provided data against investor, insurer, and regulatory guidelines, delivering immediate eligibility determinations while ensuring compliance across all loan programs.

Mortgage servicers can implement custom waterfall rules tailored to private investor or servicer-specific requirements, providing adaptability for a variety of scenarios. Automated decisioning for government loans, including FHA, USDA, VA, and PIH, ensures coverage for government-backed programs. The Waterfall Rules Engine also maintains active integrations with Freddie Mac's Resolve and Fannie Mae's SMDU, enhancing automation and accuracy for agency loans.

With centralized rules management, real-time eligibility evaluations, and bulk processing capabilities, the Waterfall Rules Engine is a valuable tool for mortgage servicers seeking to automate and maintain transparency throughout the loss mitigation decisioning process. With Stavvy, you can respond to waterfall changes in days, not weeks or months.

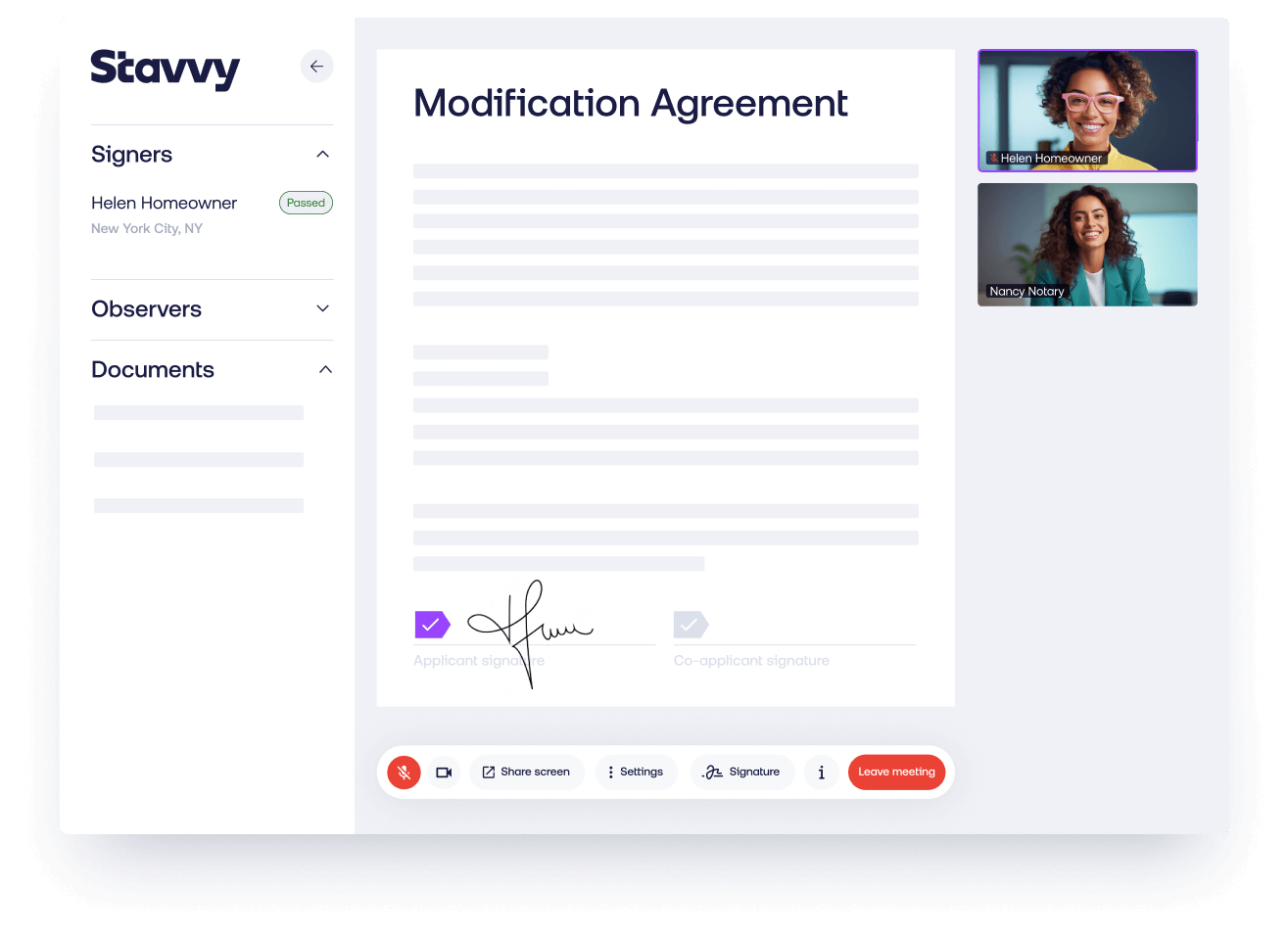

Finalize default management documents remotely and electronically

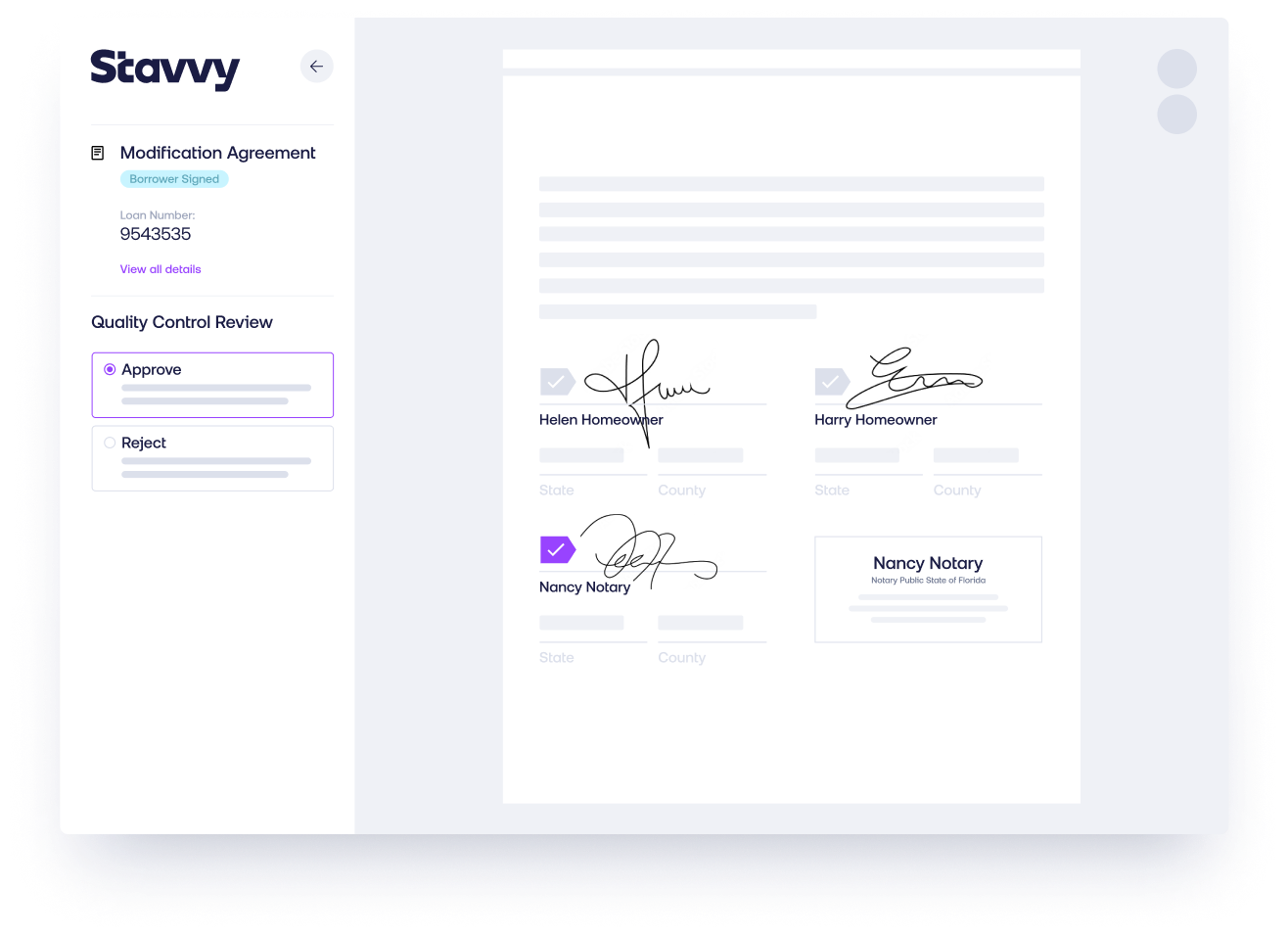

| DIGITAL EXECUTION AND NOTARIZATION HUB

The Digital Execution and Notarization Hub connects Stavvy’s RON, IPEN, and eSign capabilities with all digital mortgage servicing-related documentation. This culminating feature makes Stavvy a true end-to-end loss mitigation default management solution.

The Digital Execution and Notarization Hub allows mortgage servicers to reduce or even eliminate much of the paper associated with this process. This digital mortgage signing solution offers quick execution for consumers and lender countersigning, eliminating the unnecessary step of tracking down loan modification agreements or partial claims - meaning no more delays due to needing to re-sign because of lost mail or paperwork.

Finally, the addition of a digital signing process not only speeds up execution time but also adds an extra layer of security. Digital identity verification, fully detailed transaction audit details, video recordings, and tamper-evident documents are all enhancements to traditional mortgage servicing protocols.