SERVICER DEFAULT MANAGEMENT PORTAL

Manage mortgage default risk efficiently while reducing manual overhead

A digital-first approach that automates key workflows, reducing manual intervention and providing the transparency needed to navigate complex regulatory environments. By focusing on efficiency and compliance, mortgage servicers can manage tasks more effectively.

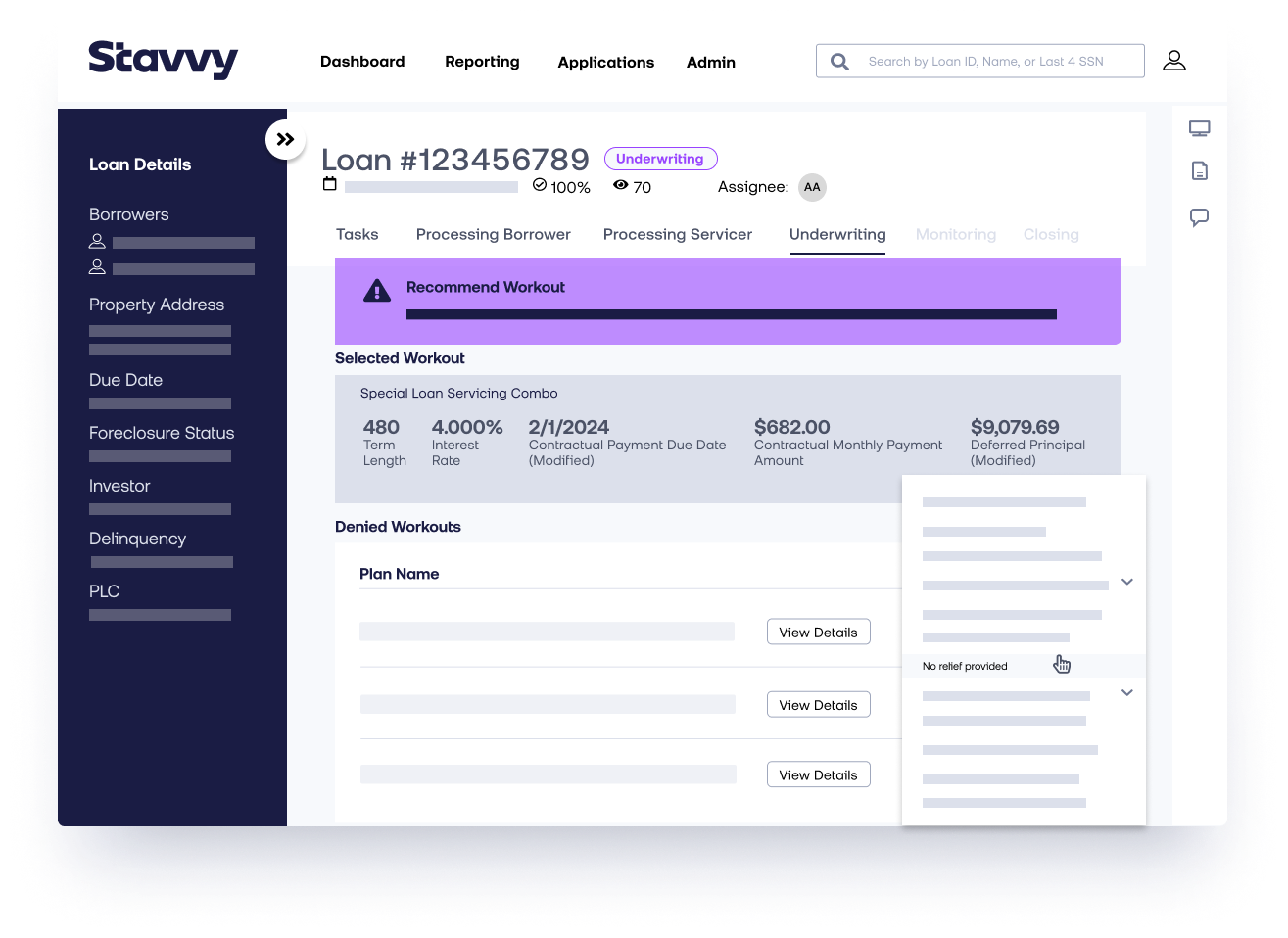

Automate your loss mitigation workflow for faster, more accurate decisions

Streamline complex processes with customizable workflows and real-time data access, reducing manual errors and accelerating decision-making.

Automated Compliance Tasks

Track participant actions, log rules engine runs, and provide complete visibility into documents, notes, and timelines, ensuring full regulatory adherence.

Real-Time Updates

Stay updated with real-time alerts for all homeowner applications, ensuring no critical information is overlooked.

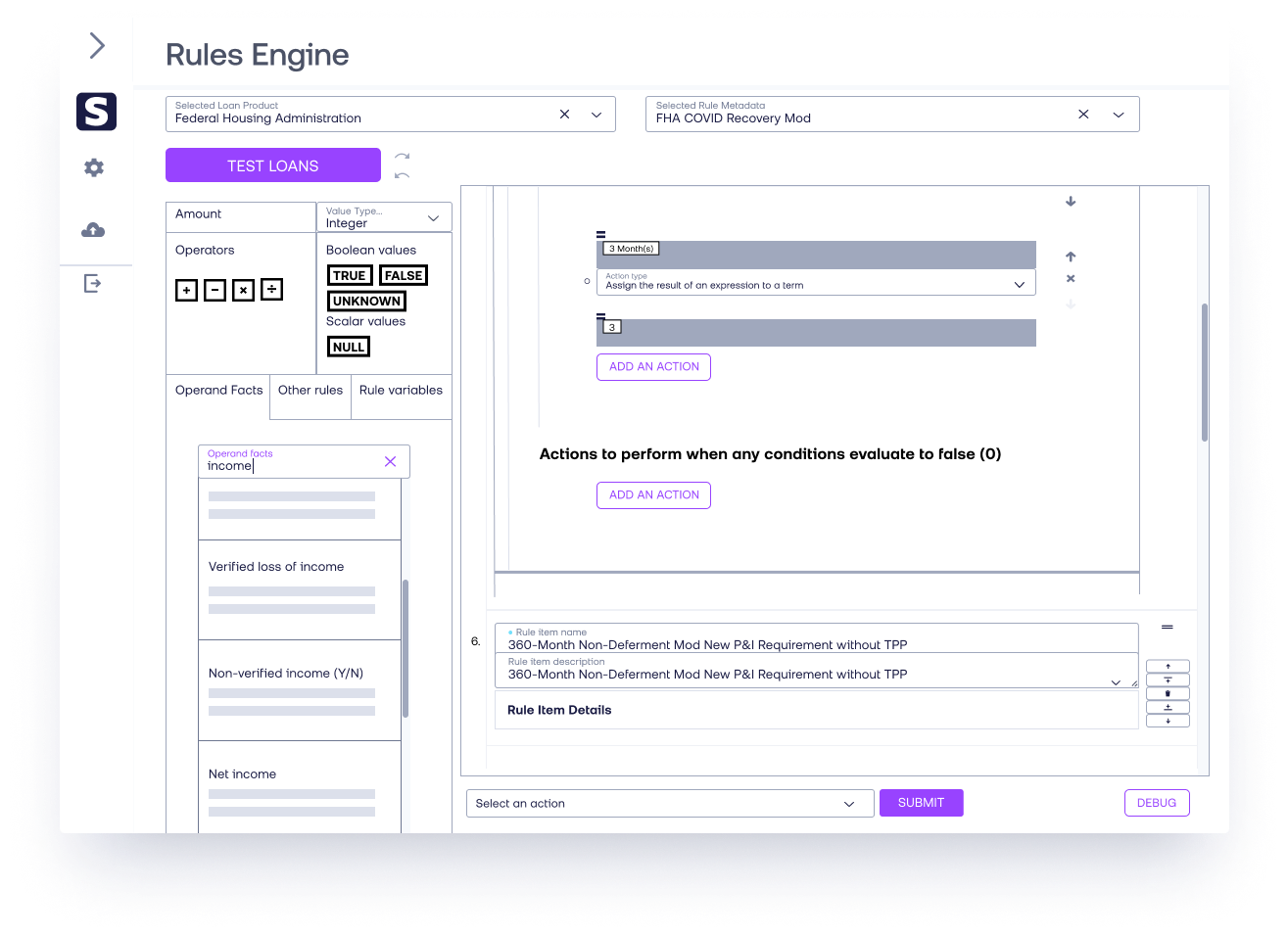

Integrated Rules Engine

Make real-time decisions based on investor, regulator, and insurer guidelines, ensuring compliance and reducing manual reviews for greater accuracy.

Collaborative, Customizable Workflows

Design workflows tailored to your business needs and equip teams to collaborate in real-time for seamless task management and faster results.

From initial application to final approval, provide a single source of truth that delivers accuracy and speed

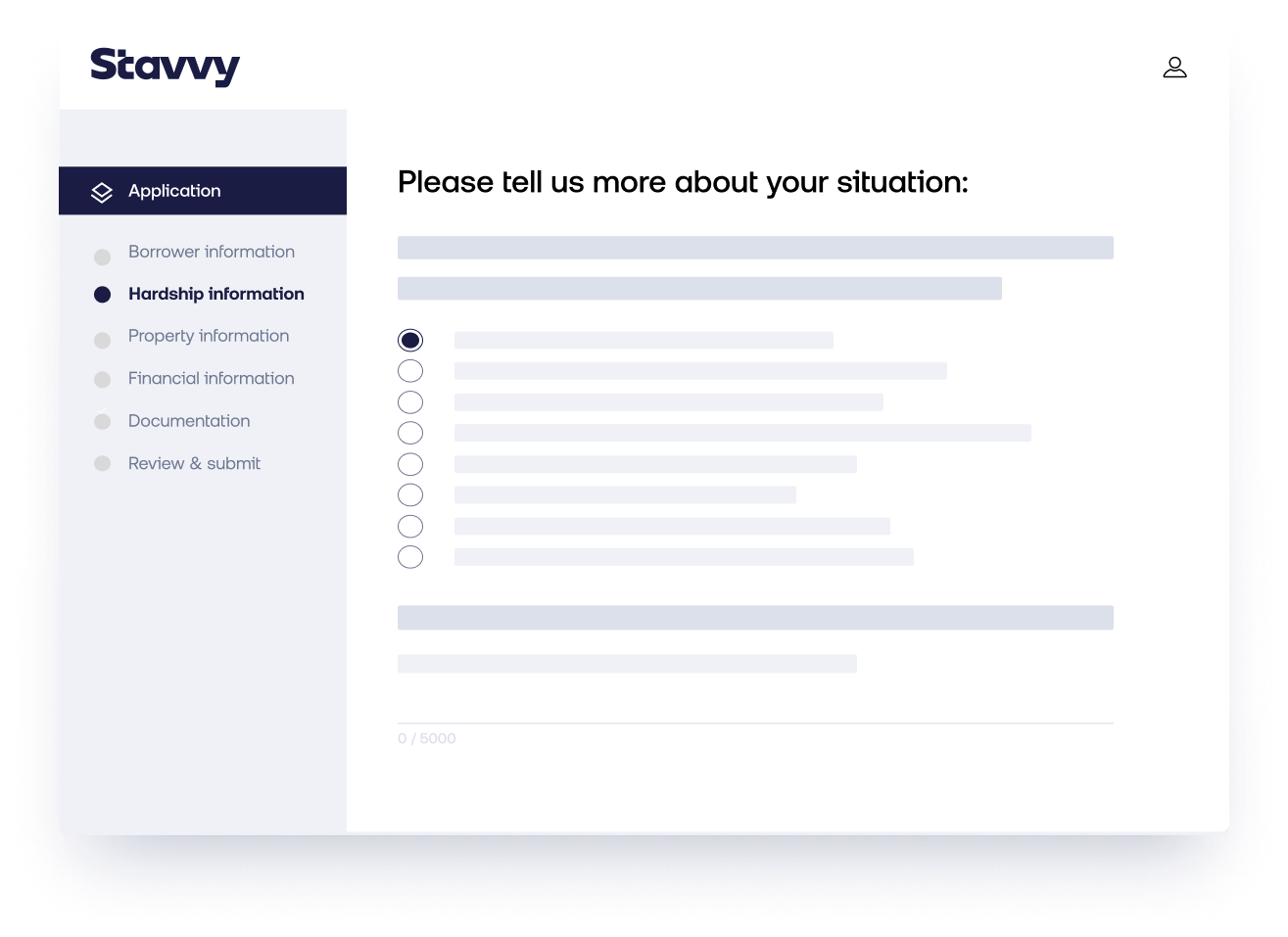

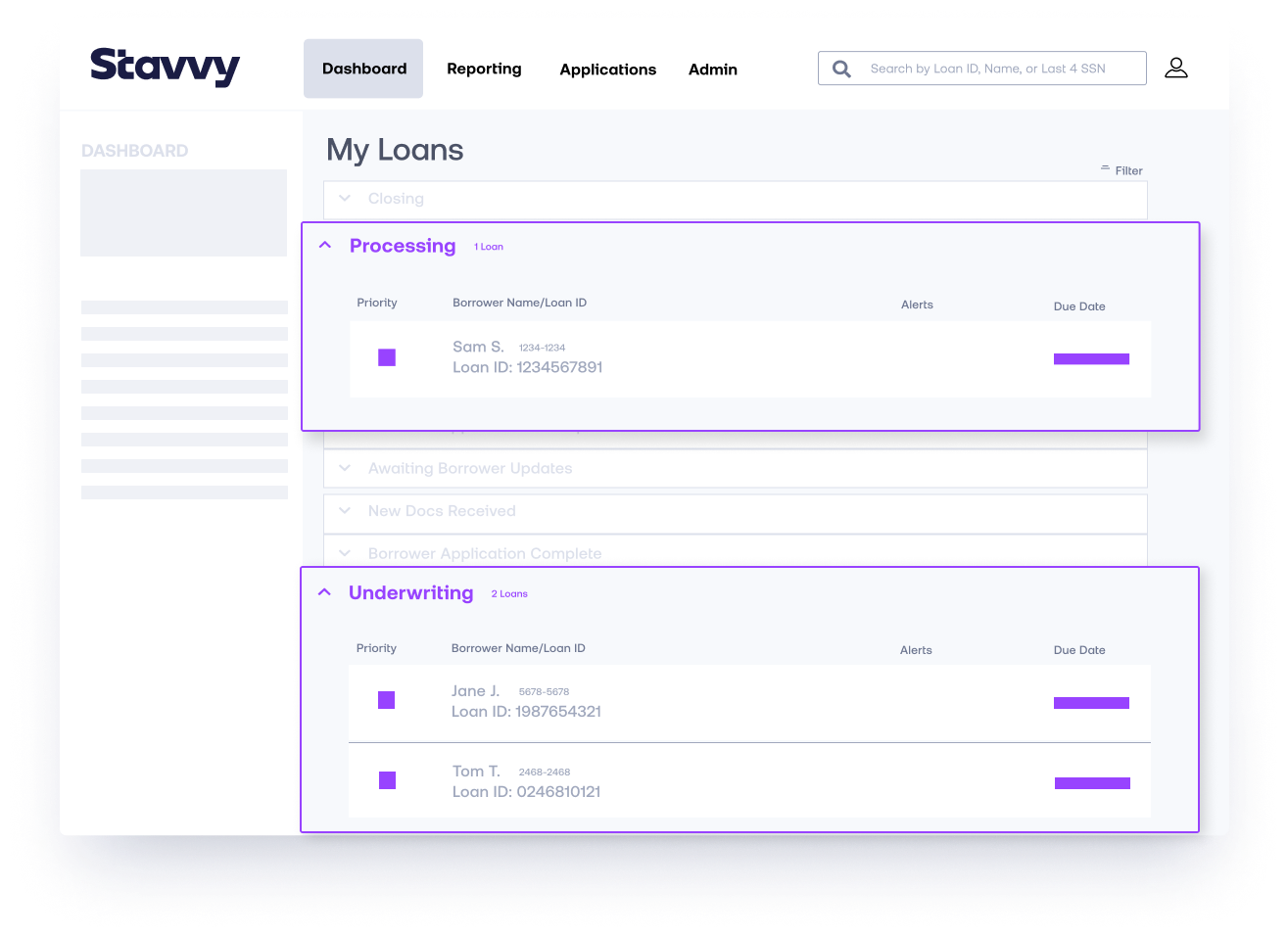

APPLICATION PROCESSING AND MANAGEMENT

Centralized and transparent application handling

Unified Platform

Manage all aspects of loss mitigation from a single source of truth. Real-time updates are visible to all users, ensuring accuracy and reducing miscommunication.

Simultaneous access

Enable multiple team members to access and edit applications concurrently, promoting collaboration and reducing bottlenecks in the processing pipeline.

Document integration

Seamlessly integrate all document types. Automatic virus scanning and mapping to corresponding data points enhances security and maintains organization.

Automated data extraction

Convert paper applications into digital formats with OCR integration, allowing for more efficient processing and decision-making.

End-to-end process support

Oversee every phase of the loss mitigation process, from initial data gathering to post-workout tasks, within a single cohesive system.

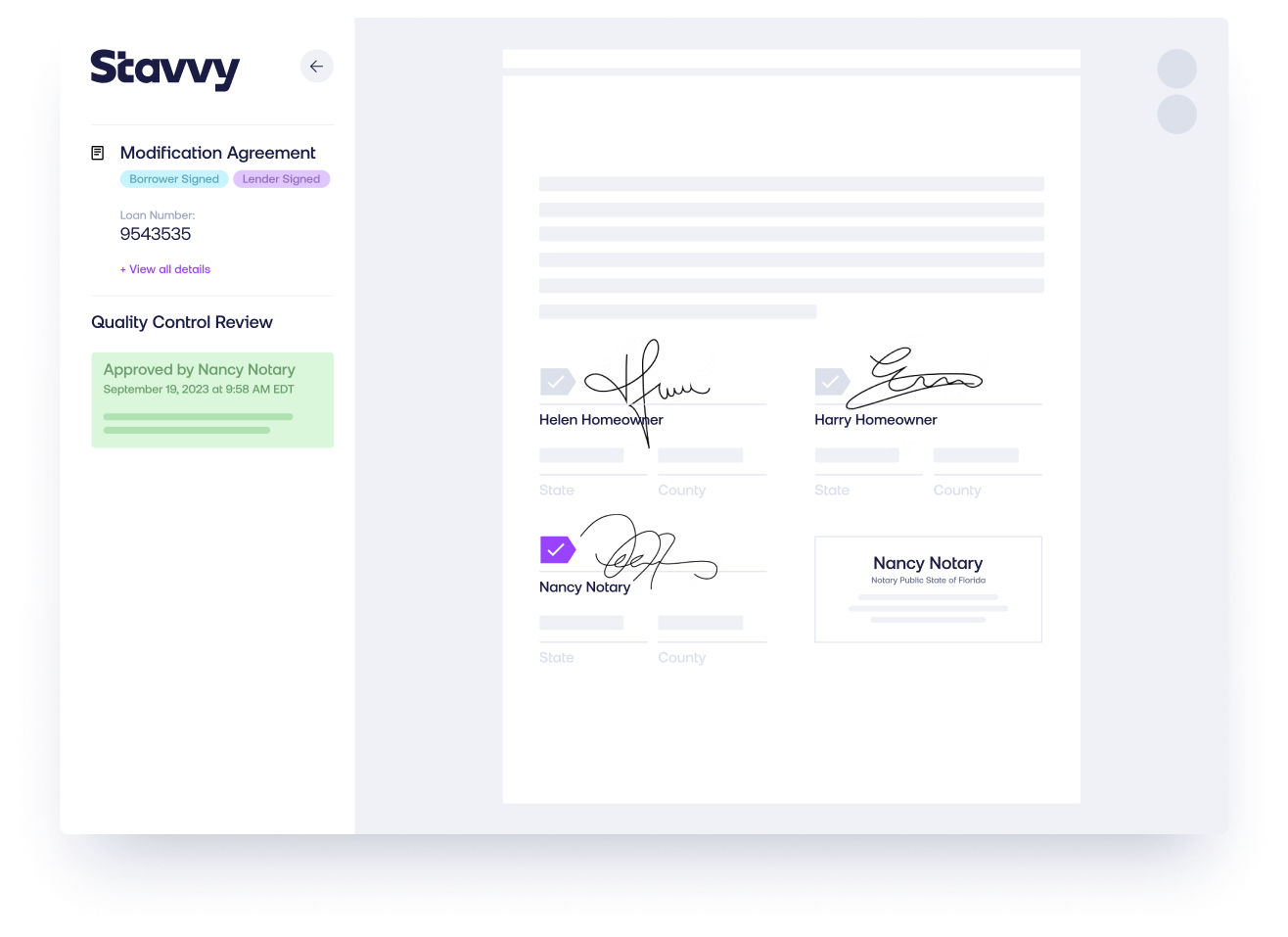

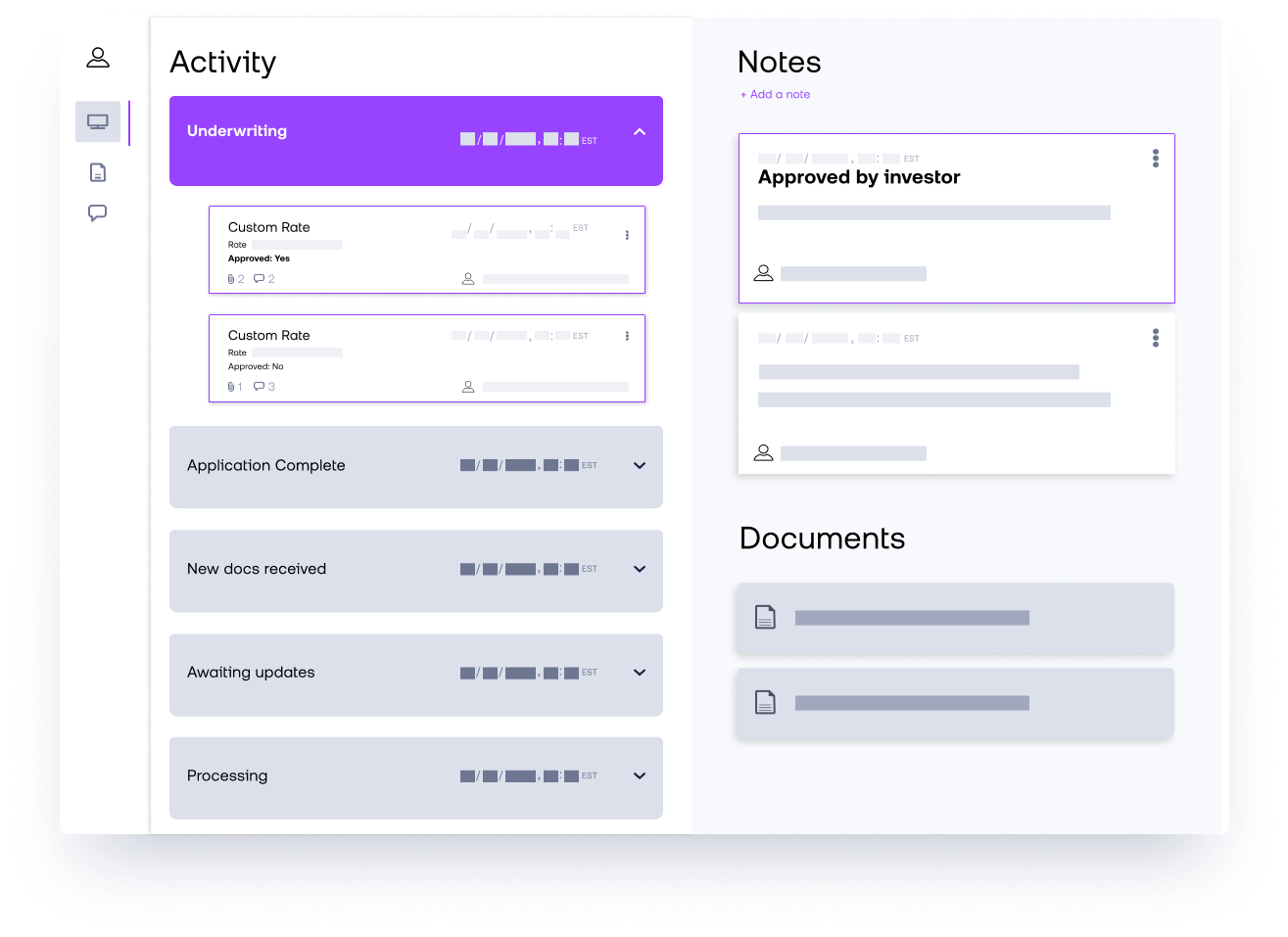

TIMELINES

Comprehensive audit trails for complete oversight

Single-view panel

Delivers a quick overview and audit log of all actions taken on each loan application, enhancing transparency.

Notes and touchpoints

Displays notes from individuals working on the file, ensuring continuity and collaboration for subsequent users.

Document and information tracking

Tracks all documents, submission times, rejections, and new submissions for full visibility throughout the process.

Waterfall rules engine records

Logs the details of every rules engine run, supporting accurate and efficient decision making.

Regulatory compliance support

Ensures adherence to regulatory and investor timelines with detailed audit trails for full compliance.

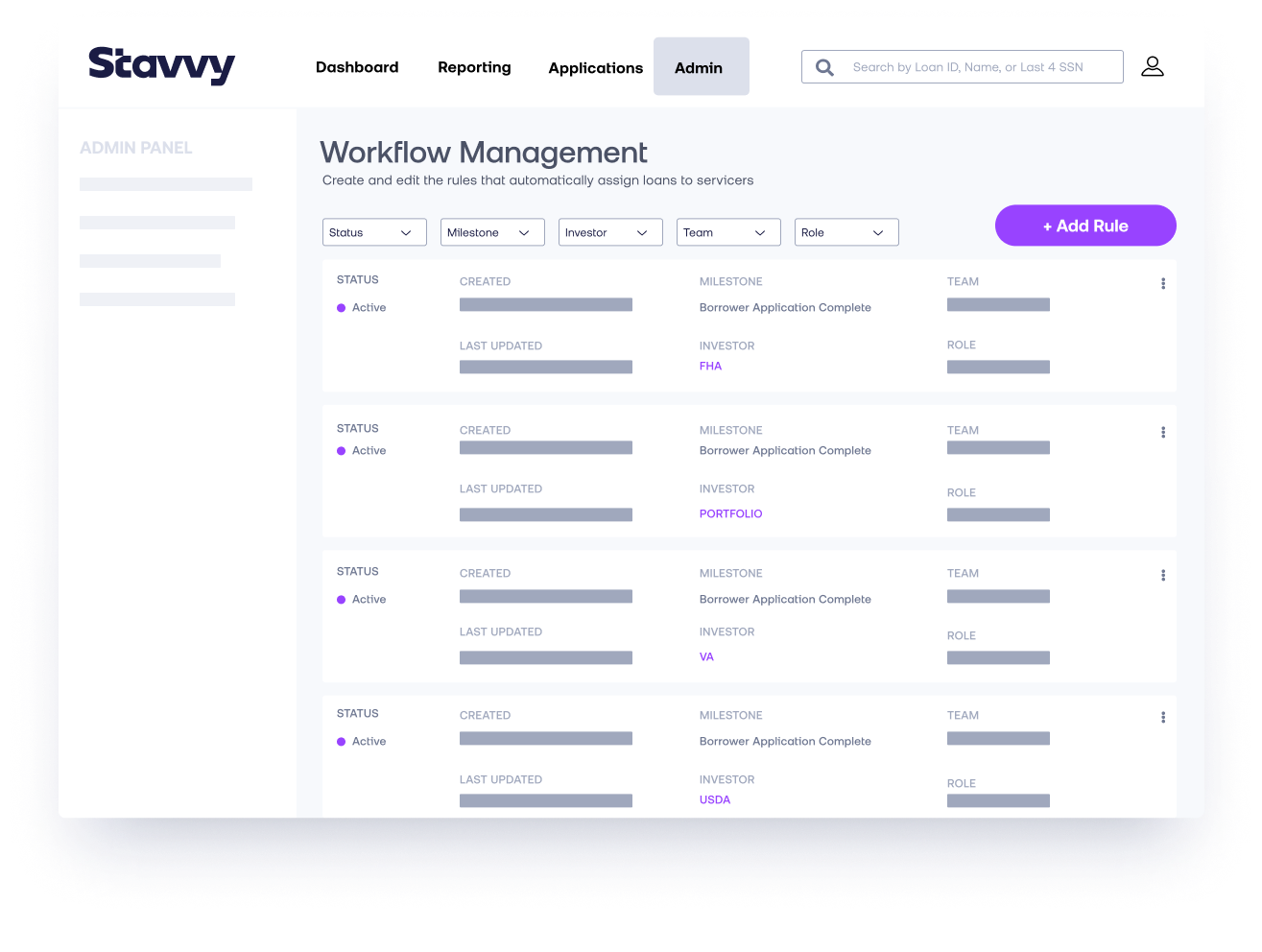

WORKFLOW ADMINISTRATION

Adaptive administration for dynamic environments

Routing rules configuration

Establish routing rules based on priorities like regulatory timelines or workload distribution, ensuring tasks are assigned where they’re most needed

Interest rate management

Apply consistent and equitable interest rates across all applications, with tools to plan for future scenarios and rates.

Integrated systems

Easily integrate with your core mortgage servicing systems for smooth data exchange.

Advanced security

Leverage integrations like Scanii for malware protection and Sensible OCR for accurate data extraction.

Regulatory compliance support

Ensures adherence to regulatory and investor timelines with detailed audit trails for full compliance.

Discover the full potential of Stavvy’s digital default servicing solution

The Stavvy platform provides an exceptional user experience for homeowners and mortgage servicing staff. Its features are designed to work seamlessly together for maximum efficiency, but can also operate independently to meet specific needs.