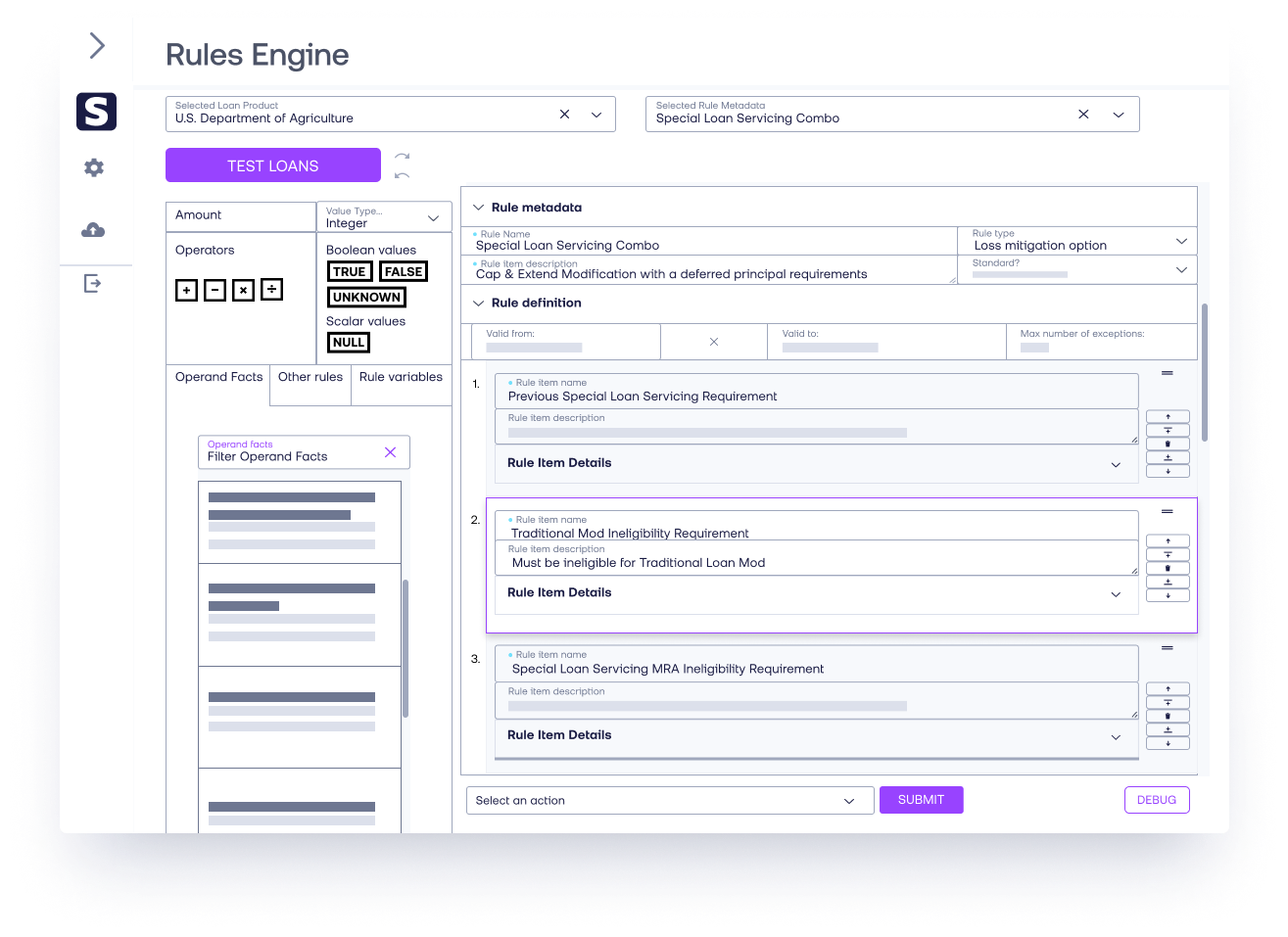

WATERFALL RULES ENGINE

Achieve faster, more informed workout decisions with an API-enabled dynamic rules engine

A customizable engine that supports real-time decisioning for loss mitigation waterfalls. Built to simplify complex processes, it allows mortgage servicers to process, evaluate, and approve homeowner data in line with investor and insurer guidelines. All while ensuring compliance with agency and private label programs.

Streamline loan decisions with flexible, real-time, and compliant waterfall rules

Configure rules to meet mortgage servicer, investor, and regulatory needs. Reduce manual input and ensure that eligibility determination remains compliant and efficient.

Automated Decisioning for Government Loans

Supports automated decisioning for all government loan programs, including FHA, USDA, VA, and PIH.

Active GSE Integrations

Supports and maintains active integrations with Freddie Mac's Resolve and Fannie Mae's SMDU to enhance automation across all agency loans.

Support for Custom Waterfalls

Implement custom waterfall rules that reflect private investor or mortgage servicer-specific requirements, providing enhanced business flexibility.

Full Reps and Warrants

Stavvy provides full representations and warranties for all rules engine outputs, supported by independent quarterly audits to ensure results remain aligned with guidelines.

Policy Management and Updates

Stavvy’s compliance team oversees rule adjustments in response to policy changes, proposing updates and providing a dedicated test environment to validate changes before production.

Dynamic Data Evaluation

Automatically assess homeowner-provided data against investor and insurer guidelines, ensuring decisions are made in compliance with policy standards.

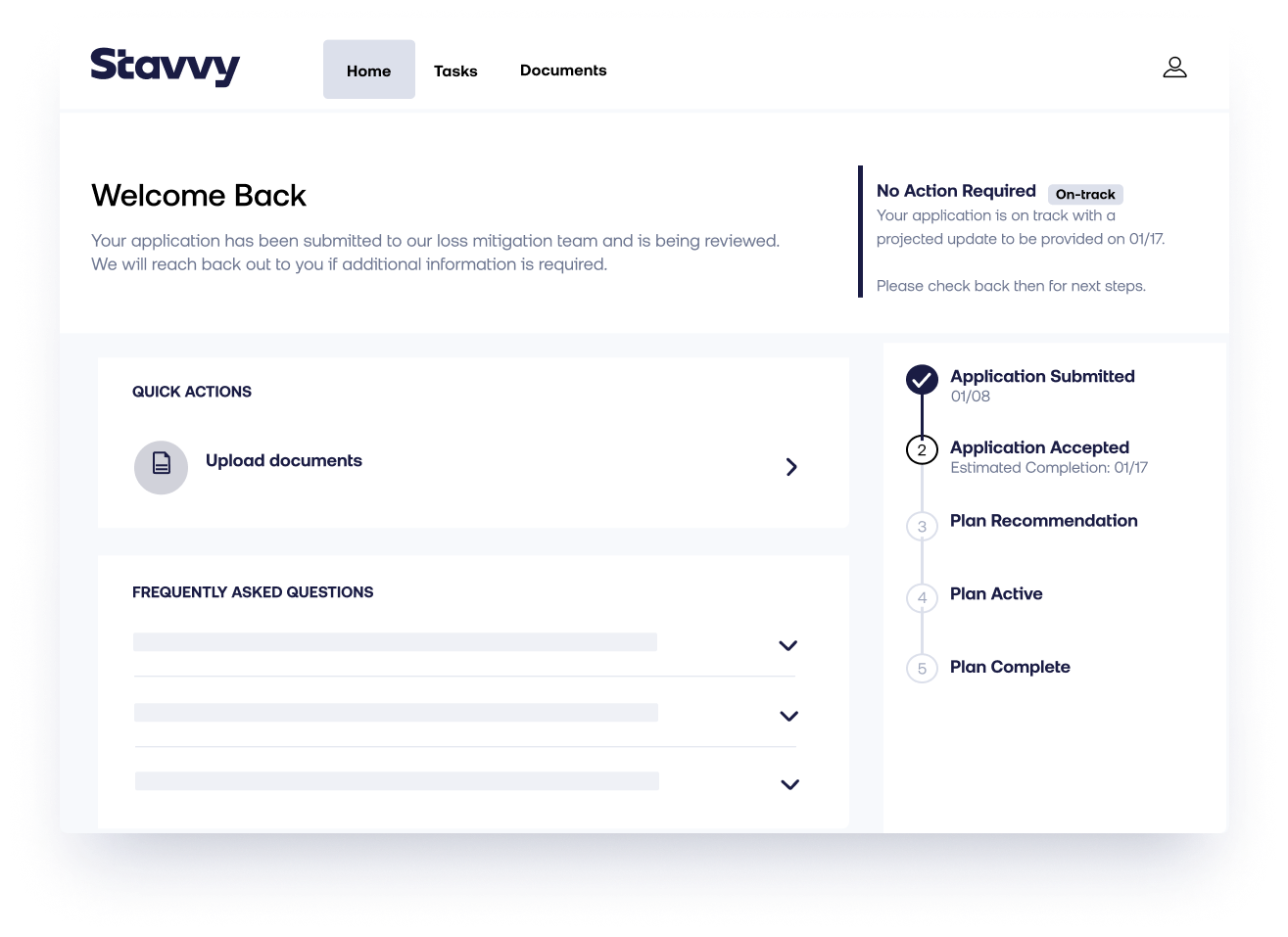

From initial data gathering to eligibility determination, maintain transparency and compliance throughout the waterfall process

LOSS MITIGATION DECISIONING

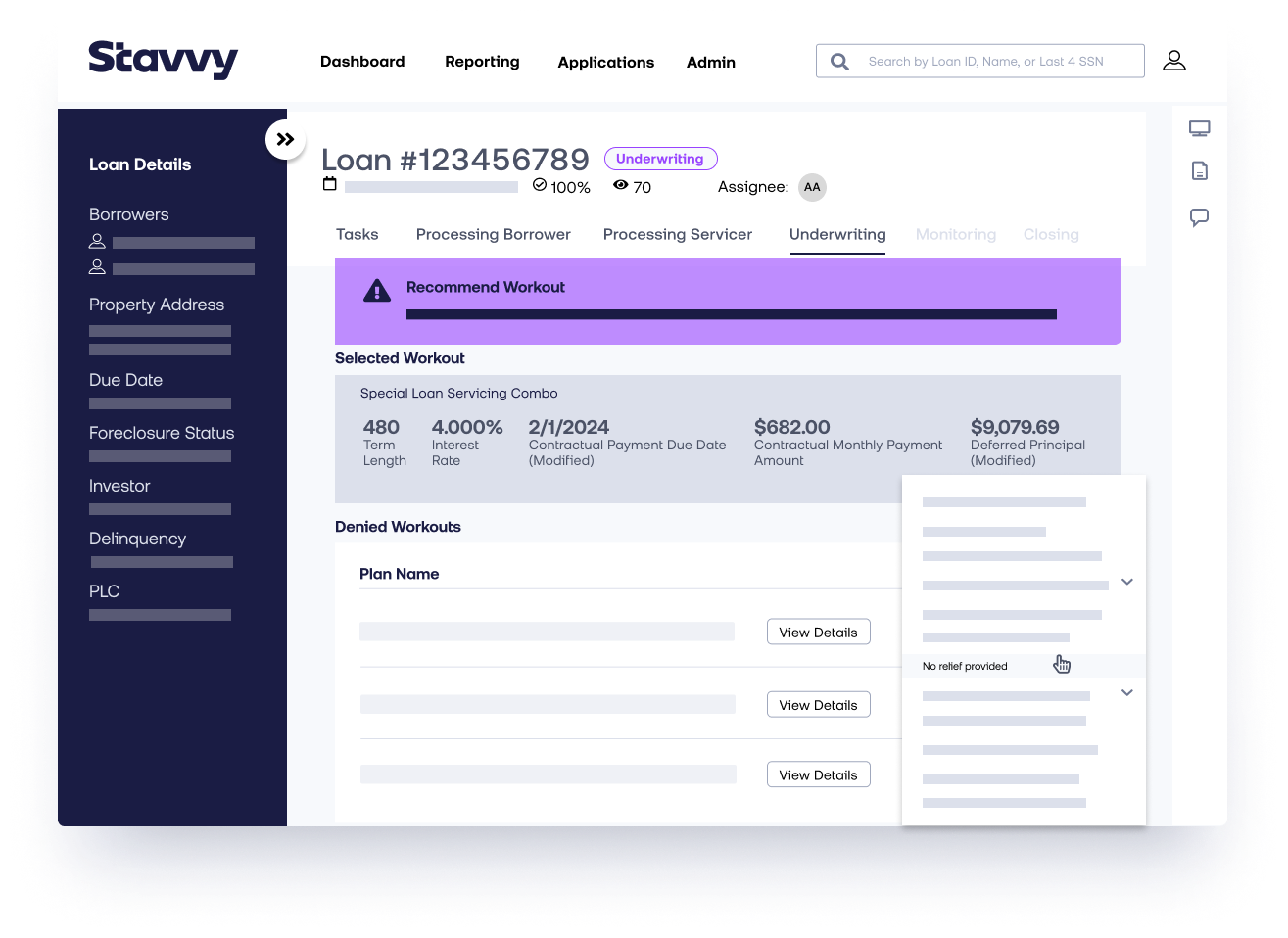

Centralized, adaptable waterfall processing

Unified rules management

Manage all waterfall rules and guidelines from a single platform, ensuring consistent and transparent decisioning across all applications.

Real-time eligibility evaluation

Automated rules processing lets mortgage servicers evaluate eligibility in real time, allowing faster and more accurate decision making.

Versioning and effective date tracking

Easily track changes to rules and confirm that decisions are made based on the correct version in line with policy effective dates.

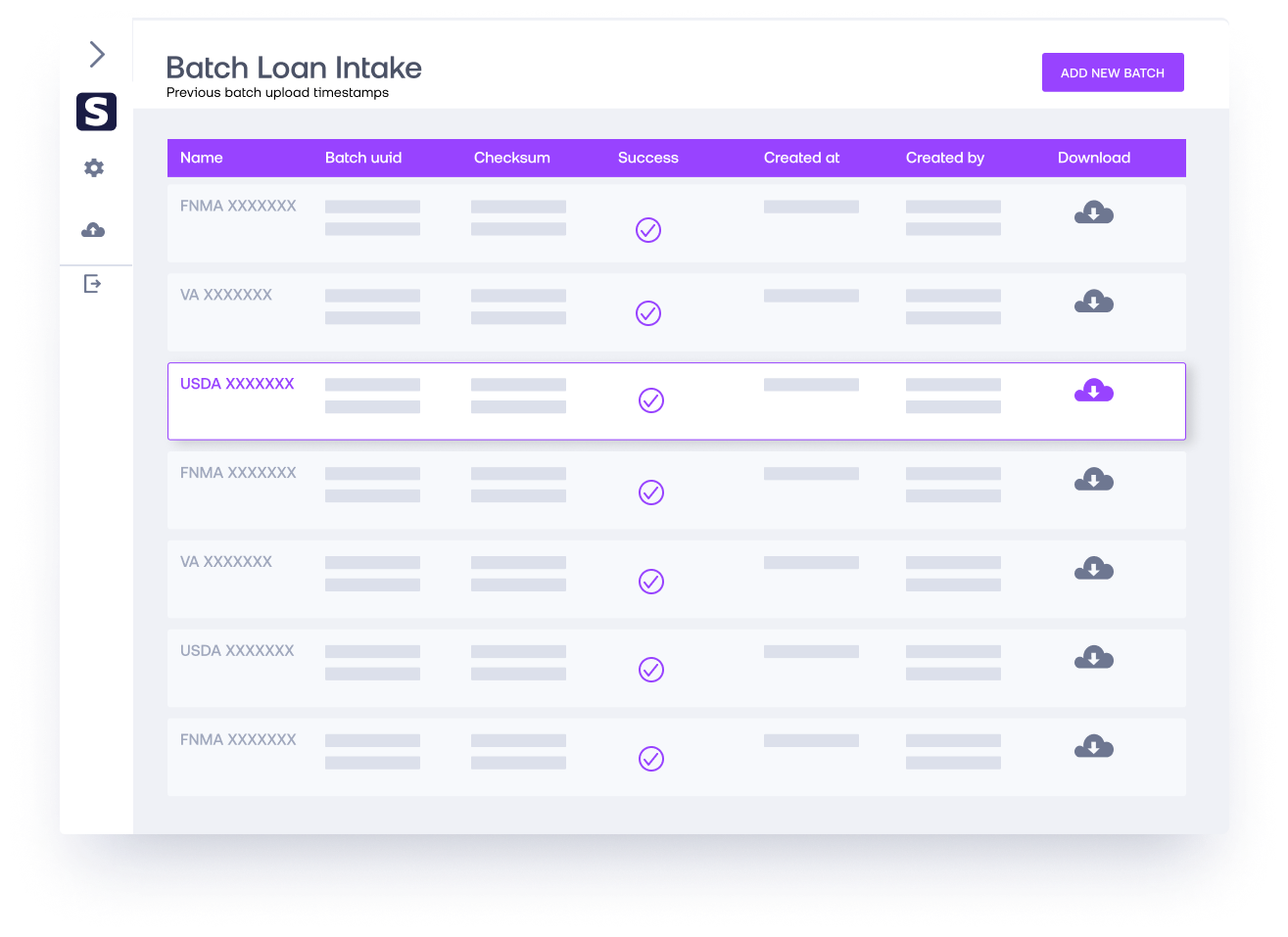

Bulk processing capability

Quickly evaluate entire loan portfolios by uploading bulk data and applying rules engine decisions across multiple loans simultaneously.

API integration

The Waterfall Rules Engine can operate as a stand-alone decisioning tool through an API or as an integrated feature in Stavvy’s Servicer Default Management Portal.

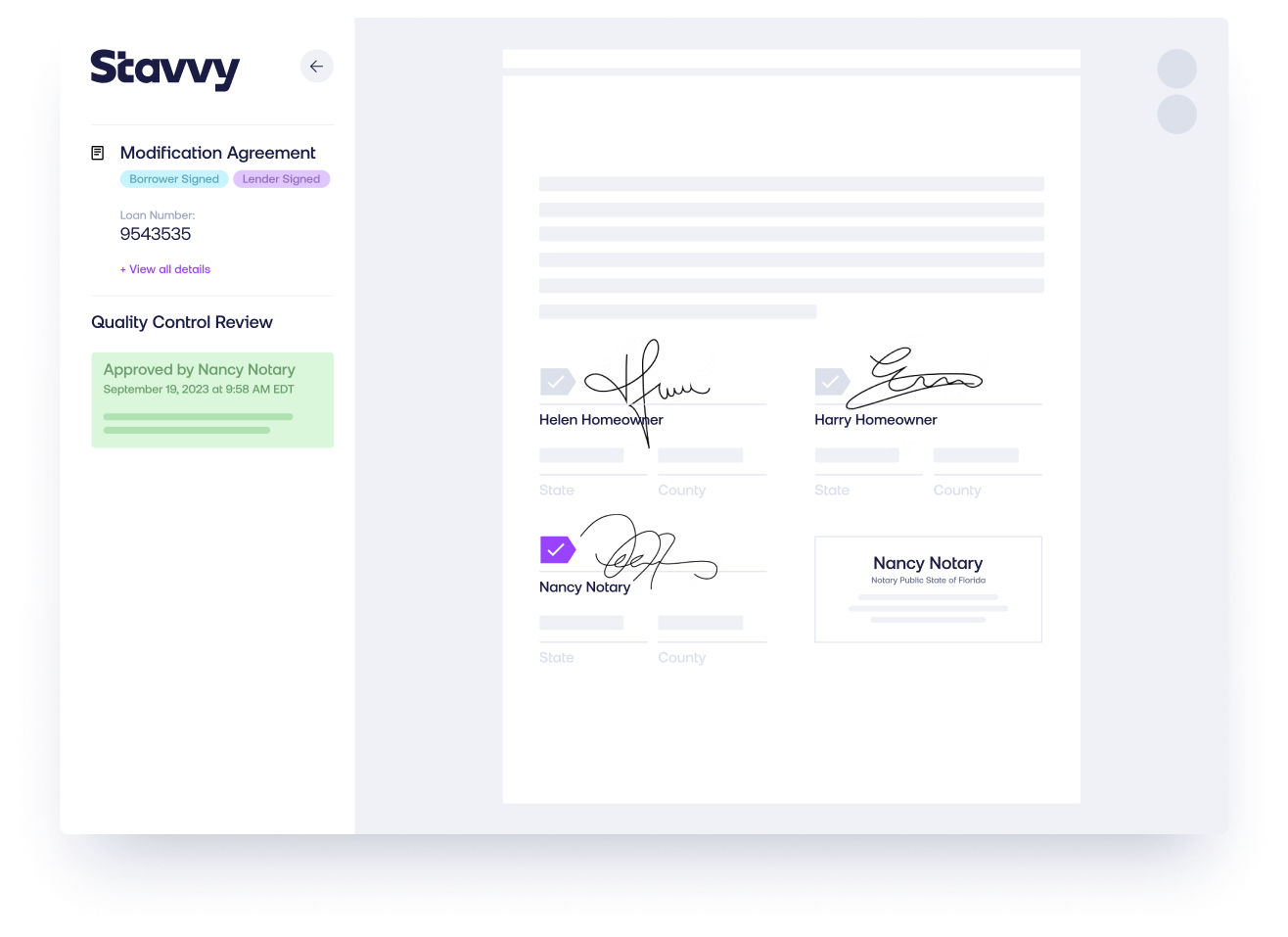

Discover the full potential of Stavvy’s digital default servicing solution

The Stavvy platform provides an exceptional user experience for homeowners and mortgage servicing staff. Its features are designed to work seamlessly together for maximum efficiency, but can also operate independently to meet specific needs.