eNote is the final step of the digital mortgage closing process

eNotes help lenders streamline their eClosing process with greater accuracy and expedited funding.

Expedite delivery to the secondary market

Leverage eNotes to shorten cycle times and expedite funding. Electronic delivery eliminates the need to process and mail physical mortgage notes.

Enhance security

eNotes offer greater protection than paper mortgage notes. The tamper-evident seal applied after signing ensures that the eNote remains unaltered post-closing.

Improve operational efficiency

An eNote can enhance efficiency by simplifying the signing process, improving data quality, and mitigating the risk of misplaced or lost notes.

Offer greater transparency

Improve transparency by allowing all mortgage stakeholders to view the eNote’s information at any time while leveraging the MERS® eRegistry to identify the note's rights-holders and conduct transfers.

MISMO® certified solution

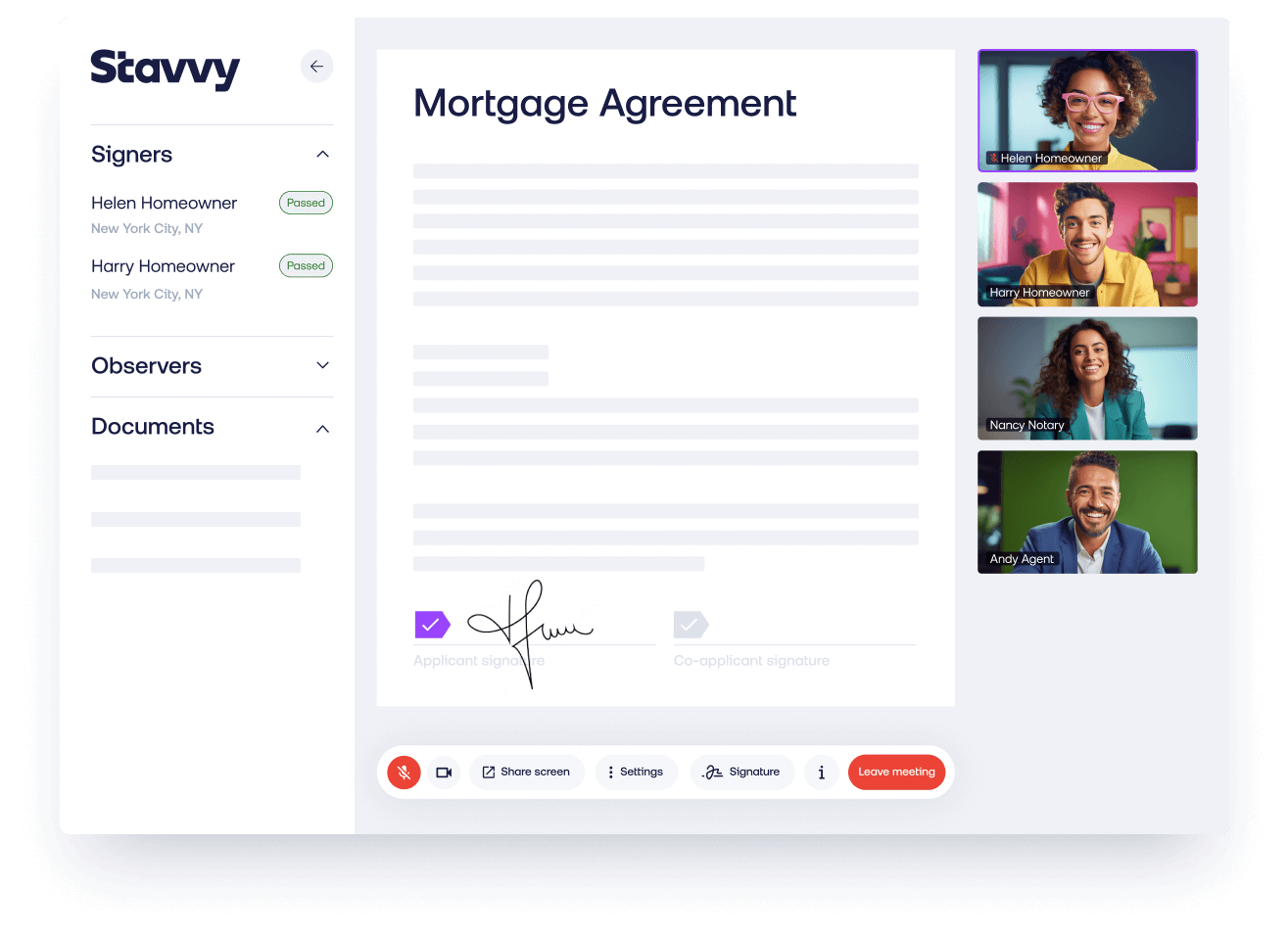

The Stavvy platform meets MISMO standards and best practices so that you can conduct remote notarization with confidence.

SOC2 Compliant

Stavvy maintains a SOC 2 Type 2 audit report to demonstrate our commitment to protecting the confidentiality, integrity, and availability of customer data.